Due to the current challenges with casualty exposure data and the numerous assumptions that need to be made to estimate casualty catastrophe losses, Guy Carpenter is developing a model that is as simple, transparent and as data-driven as possible, while still being able to achieve results that are sensitive to the things insurers can do to mitigate their casualty cat risk, such as changes to insured industry concentrations, limits, attachments and reinsurance coverages.

Our model is intended to focus initially on a select group of technological, crystalizing and to a lesser extent aggravating risks that are of interest to our clients. It is also intended to be complementary and supplementary to the various other models and approaches being pursued.

Simple and transparent: our model is scenario-based. This provides an intuitive check on results.

Data-driven: To create these scenarios we have relied upon a variety of industry sources including Advisen's® database of 200,000 historical losses.

Version 1 of our model, scheduled to be released later this year, is an essential start in this complex field that will enable clients to:

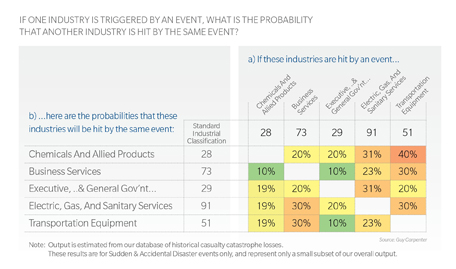

- View and analyze unexpected industry portfolio concentrations. It is easy to see where concentrations are in any one industry. However, clients will be able to map how all the industries have been interrelated in past, similar events. These linkages can reveal unexpected concentrations in portfolios.

- View and analyze how casualty catastrophe loss estimate changes as the portfolio changes. Instead of focusing on the absolute value of an estimated casualty catastrophe loss, a carrier may get more value by seeing how the loss changes directionally and on a relative basis as their portfolio's industries and exposed limits change. An insurer can also apply "what if" analyses to analyze the impact of proposed changes.

- View, analyze and stochastically model how the casualty loss estimates compare with the industry loss for various specific realistic disaster scenarios. Guy Carpenter's approach allows an insurer to see how their loss compares with the industry loss, and whether it is out-sized compared to an insurer's market share.