The use of capital markets-based risk transfer capacity by public entities, insurers of last resort, and compulsory catastrophe pools and disaster facilities continues to expand. These deals included Turkey's Turkish Catastrophe Insurance Pool, Mexico's FONDEN and New Zealand's EQC. Most large U.S. insurers of last resort, such as CEA, Citizens (FL), Citizens (LA), North Carolina Joint Underwriting Association and the North Carolina Insurance Underwriting Association (NCJUA/NCIUA), and Texas Windstorm Insurance Association, are utilizing capital markets capacity including collateralized reinsurance and catastrophe bonds.

Given GC Securities' leadership in placing capital markets-based solutions for public entities, insurers of last resort, and compulsory pools and disaster facilities, we have seen that the use of capital markets-based capacity has been instrumental in many ways. It provides cost savings to these entities allowing them to utilize such savings to build surplus or buy needed additional coverage; it improves coverage terms (transforming programs from per occurrence to annual aggregate responses) and it provides leverage to keep traditional capacity sources honest and to facilitate their willingness to adjust coverage terms that may not have been feasible without the use of capital markets-based risk transfer capacity. Also, as public entities strive to reduce public debt, there is a clear benefit derived from limiting the risk that natural perils can pose to a state's balance sheet. At the time of loss, governments may be spared these enormous costs and they may have enhanced flexibility to finance economic and social development or reduce taxation.

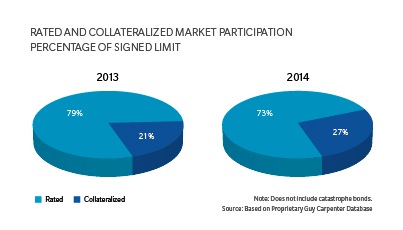

Because entities such as windpools tend to be limited in geographic scope and/or peril, with more of an affinity for single limit/aggregate coverage, they present an attractive profile to collateralized reinsurers and catastrophe bond investors. Competition and excess capacity for this business has significantly reduced price and in just the past year, the growth in both limit purchased by these entities and share of overall limit placed into the collateralized market has been significant. As an example, profiling limits purchased by U.S. windpools in 2014 compared to 2013, catastrophe bond limits increased by almost 50 percent while rated and collateralized reinsurance limit purchased grew by approximately 30 percent, leading to a total growth in coverage of roughly 35 percent. In addition, the collateralized market share of the limit purchased has outpaced the growth in rated carriers' increased participations as detailed in the figure below.

Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities Corp., a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities Corp., MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the U.S. Patent and Trademark Office.