History shows that the insurance market is cyclical, and this is especially true for casualty lines of business. As long-tail lines, the ultimate profitability of a year is not known for many years as changing loss trends and causes may not be recognized until it is too late to protect against adverse development.

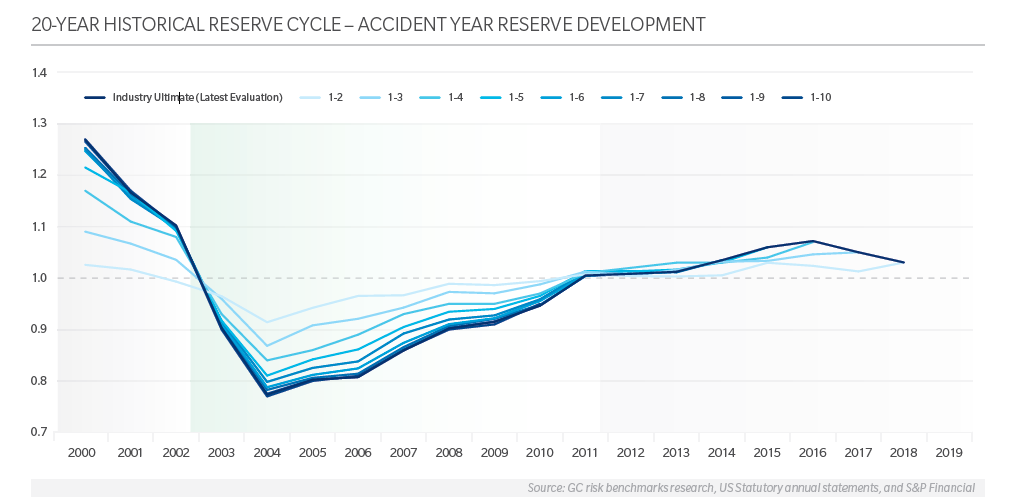

The casualty marketplace now finds itself in such a position, according to Christopher Ross, Managing Director, Guy Carpenter. The chart below shows this cyclicality since 2000 for commercial auto, other liability occurrence & claims made, products liability and medical professional.

In the chart, the baseline represents the normalized original loss ratio selection for each year: the industry’s collective initial loss ratio selection on anticipated performance in a particular year. The lines then show how each year actually developed over a 10-year period. When the line moves above the baseline, the loss ratio selection has increased, representing adverse development, and when it moves below the baseline, the ultimate loss ratio has decreased, representing positive development and reserve releases.

We can conclude from the data that a year that starts to show increases in casualty lines loss ratios will continue to show increases in loss ratios. We now see this in the most recent period, with losses moving upwards in a current phase of general adverse development across these casualty lines. Thus far, this adverse development has been concentrated in commercial auto and general liability occurrence lines, with medical professional liability and other liability claims made also showing signs of adverse development in the most recent development periods.

Conversely, workers compensation has been a different story, with reserve releases occurring during this period. Therefore, the market is grappling with some key uncertainties that impact not only go-forward underwriting and pricing strategies, but also capital strategies for both servicing the legacy portfolio as well as growth as the market hardens.

- What caused the change? Understanding this helps determine the size and scope of corrective actions to improve profitability.

- How much more development will there be in the recent reserve period?

- How much capital is tied up to service the tail versus being deployed to capitalize in a hard market? Are there solutions, such as an adverse development cover (ADC) that could be a way to release capital rather than having to raise it in the investment markets?

Those companies that can solve for these uncertainties quickly are in the best position to take advantage of the current hard market opportunity and the next cyclical period.

To answer the first question, since 2011 a clear change has taken place in claim frequency and severity across most casualty lines. One driver is now commonly referred to as “social inflation,” but there has also been an increase in large, catastrophe-type claims over this period. A changing legal environment, increasingly punitive jury pools, third-party claim financing and medical advances all made the value of claims increase. We see this particularly in commercial auto and umbrella where the lead umbrella limits are often impacted by auto losses that historically stayed within the primary USD 1 million auto policy limit. This trend coupled with a spate of large loss and systemic events, such as the opioid crisis, wildfire claims and industrial accidents, not to mention very long-tail sexual abuse and molestation claims arising from changed survivor statutes, has affected all areas of the casualty market: primary, lead and excess liability carriers.

In response to this, the marketplace is taking corrective actions including price increases, limit reductions, attachment point changes and underwriting appetite shifts all meant to re-position portfolios going forward.

Now, in 2020 we are experiencing the impact of COVID-19. COVID-19 has acted as an accelerant in terms of both the pricing and capacity usage trends previously sought. It has further increased uncertainty on the economic, liability and regulatory landscapes. In a time of low interest rates, investment returns will decrease. Close regulatory scrutiny of policy wordings and language is also likely to take place. There are also uncertainties regarding whether immunities will be put in place for businesses as they re-open, to limit future liabilities.

With this level of uncertainty, including lack of a full understanding of how much more development will take place in the most recent adverse development cycle (see question two, above), it is clear the market will continue to harden.We expect pricing to continue to increase. And with limit and attachment point strategies currently in place, further hardening in the overall casualty market will take place.

Guy Carpenter’s capabilities help our clients understand the potential for latent development. Using our MetaRisk® Reserve™ model, we can test the impact of different development patterns, loss trends and strategies on held reserves. Being able to understand the potential scope and scale of development leads directly into go-forward strategies, particularly for capital management.

Capital management strategies are critical for carriers as they need to find the proper balance between allocating capital to potential past losses and deploying it now to support business growth in a hard market. We see a few ways to address this requirement through Guy Carpenter’s solutions:

- Increase the use of traditional reinsurance going forward

- Raise capital

- Release capital on prior years via the use of ADCs or loss portfolio transfers.

We have seen and implemented all of three of these solutions now. Given the challenges we have outlined on how to pivot from portfolio protection to growth we fully expect these will continue through 2020 and 2021. Increasing the certainty of profitability (lowering volatility of earnings) will be valued ever more by investors, and finding the right balance and solutions are critical to solving that problem.

Guy Carpenter’s broking and analytical teams provide insight using the sector’s most tailored solutions and best strategic advisory services as we provide guidance to clients through the January 2021 renewal cycle.

Click here to register to receive email updates >>