The reinsurance industry has seen new capital formation activity following the COVID-19 outbreak last year, and there has been favorable growth in premium and in the investment environment this year. There is now increasing clarity around COVID-19 exposures, and the industry enjoys diversification and scale benefits.

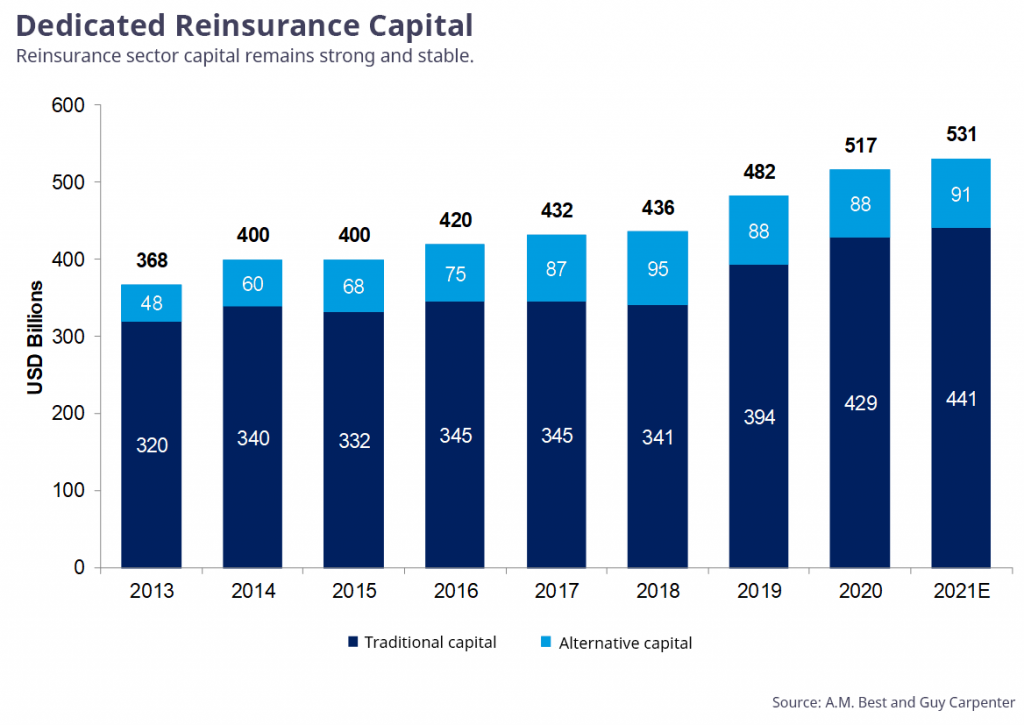

Guy Carpenter and A.M. Best jointly estimate the total dedicated reinsurance industry capital at midyear 2021 to be USD 531 billion. This is approximately 2.8% higher from year-end 2020. Traditional capital has increased from USD 429 billion to USD 441 billion or approximately 2.7%, while alternative capital has increased from USD 88 billion to USD 91 billion or about 3.5%.

These circumstances result in the reinsurance industry being healthy from a capital perspective despite major loss activity in the first half of 2021 being at a 10-year high due to higher-than-average losses in the US and Europe. In fact, excess capital build and recovery in valuations is now leading to a rebound in dialogues about strategic and transformational deals.

Alternative capital currently forms about 17% of the total dedicated reinsurance capital. This segment requires careful monitoring because it provides a significant portion of the industry retrocessional capacity, which in turn affects the broader availability of reinsurance.

This alternative capital is split across various subsectors. As of mid-year 2021, Guy Carpenter estimates that approximately USD 32 billion or 35% was allocated to the 144a cat bond product and USD 11.5 billion or 13% was allocated to collateralized quota shares or sidecars. The remaining USD 47 billion was deployed toward non-proportional collateralized reinsurance or retrocession.

The sidecar or quota share market has grown despite past challenges of surprise losses, loss creep and collateral trapping. The increased allocation has come mainly through direct bilateral arrangements with foundational investors rather than through syndicated placements with dedicated insurance-linked securities (ILS) funds.

In these arrangements, there is a keen differentiation across cedents based on their past underwriting experience, loss reporting and collateral release terms. Besides pressure on structural terms and conditions, there is a real focus on the override. Demand for this capacity is currently outpacing supply.

The non-proportional collateralized reinsurance markets have increased their use of rated fronts to make it easier for them to participate on programs. They are also focusing on contract language, coverage and exclusions, and timely loss reporting issues similar to the traditional markets.

Investors’ mandates have shifted toward liquid ILS strategies and capacity is available on the sidelines to be deployed toward such strategies while the broader capital markets remain starved of yield.

Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities LLC, a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the United Kingdom by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities LLC, MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh McLennan. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product.