PRICES, TERMS AND CONDITIONS

The Japan market experienced challenging renewal conditions at April 1, as tightened approaches from reinsurance underwriters left cedents contending with higher pricing trends. Rates were up in all property catastrophe and per risk lines. Casualty lines showed a mixed picture, but the general trend was for modest increases. Low rate on line (ROL) business came under particular pressure for rate increase across classes.

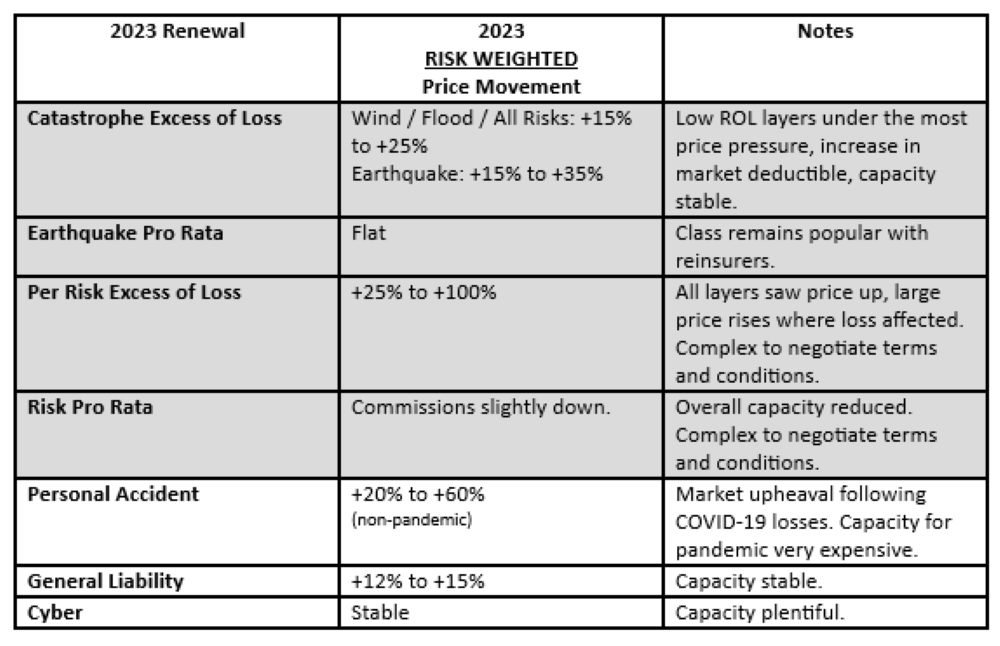

Japanese Renewals: Typical Risk Adjusted Price Movement Per Unit of Capacity Source: Guy Carpenter

Source: Guy Carpenter

For catastrophe lines, prices had already increased for 4 years in a row following the loss-making 2018 typhoon season, and the 5-year compound price increase is now very significant. For catastrophe excess of loss covers, prices are back to a level last seen nearly 30 years ago.

Quoting and Price Negotiation

Quote-to-firm-order timelines for main layer domestic catastrophe excess of loss programs (Cat XLs) were similar to those experienced in recent years. However, in contrast to some prior years, more robust negotiations were undertaken in order to achieve reinsurer concurrency at market consensus terms. Away from the domestic renewal, the pricing process for covers protecting worldwide exposures was more difficult, especially where US exposures were included.

Capacity

There was no shortage of theoretical capacity for most lines of business, but tightened underwriting requirements meant that there were some constrictions in supply for cedents that were not willing to be flexible in accommodating reinsurer coverage requests. In property lines, the demand/supply dynamic could be described as loosely correlated to the complexity of the underlying business. This meant that there were few shortages for domestic catastrophe but there was a tighter market for worldwide catastrophe. Similarly, there was more capacity available for cedents willing to introduce new coverage restrictions or exclusions to per risk covers than for those that sought “full” cover.

Coverage

The protracted wordings negotiations observed at the January 1 renewals implied that coverage in per risk covers was likely to be a pressurized area in the renewal process, as well as a possible capacity pinch point. Negotiations certainly required a degree of finesse, but dramatic changes were not required.

One problem faced by cedents was that there was no clear market direction on any of the coverage items at issue, so it was hard to set a marketing strategy with any degree of confidence. The default position generally adopted was to make an initial approach to the market on a “terms as before” basis and then decide what tactic to apply to reinsurer coverage requests once replies were received. Ultimately, there were no significant changes to domestic Cat XL but some changes in per risk covers.

Inflation

Japan traditionally has zero or very-low inflation rates, and it was clear that it experienced much lower levels of inflation in 2022 compared to other countries. Many reinsurers were willing to acknowledge this difference, in that it would not logically make sense to take US or European loadings and apply them to Japanese exposures. Reinsurers, therefore, looked to Japanese clients to provide clear information on the degree of inflation seen in actual claims to date, projections of likely future claims costs, as well any strategies deployed to deal with ongoing inflation (such as valuation methods and application of average clauses).

Reinsurer Behavior

Most reinsurers approached the renewal expecting general hardening of terms and conditions, which appeared to be a realistic stance considering the market background. In general, given the characteristics of the Japanese market, reinsurers also were willing to negotiate to an outcome that clients could understand and usually accept, although this was not the case in every instance and the renewal was marked by a few late changes in stance and some intransigence. Those negotiations were stressful for all involved. The Japanese market prides itself on valuing the stability of relationships. For example, treaty leaders are rarely changed. However, this renewal was marked by a relatively high change in lead reinsurer compared to what the market normally sees.

PROPERTY CATASTROPHE

Domestic Catastrophe Excess of Loss

Prices increased by 15% to 35% for catastrophe XLs. As a result, the average price for typhoon risk remains at historic highs. Total purchase declined, reflecting increased retentions and budget management by cedents. Capacity was sufficient to meet demand.

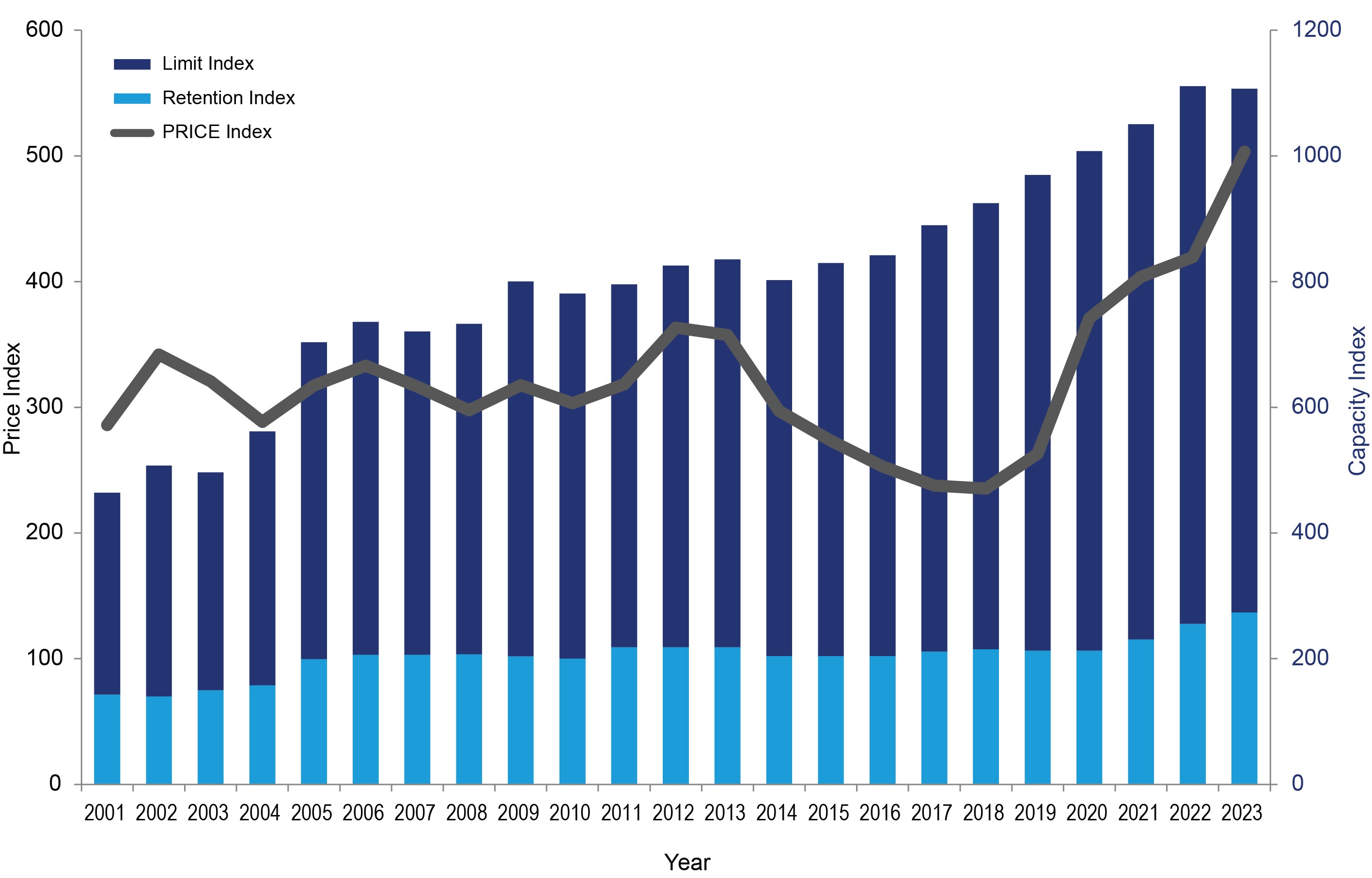

Japanese Companies Windstorm XL: Capacity, Retention and Price Source: Guy Carpenter. Chart shows total Wind / Flood / All Risks XL price and capacity purchased, including via combined XLs.

Source: Guy Carpenter. Chart shows total Wind / Flood / All Risks XL price and capacity purchased, including via combined XLs.

Buyers reacted to market pressure and acknowledged their own budgetary realities by managing cost through increased retentions, along with increased co-reinsurance shares in some cases. Consequently, total capacity purchased was reduced compared to the expiring year.

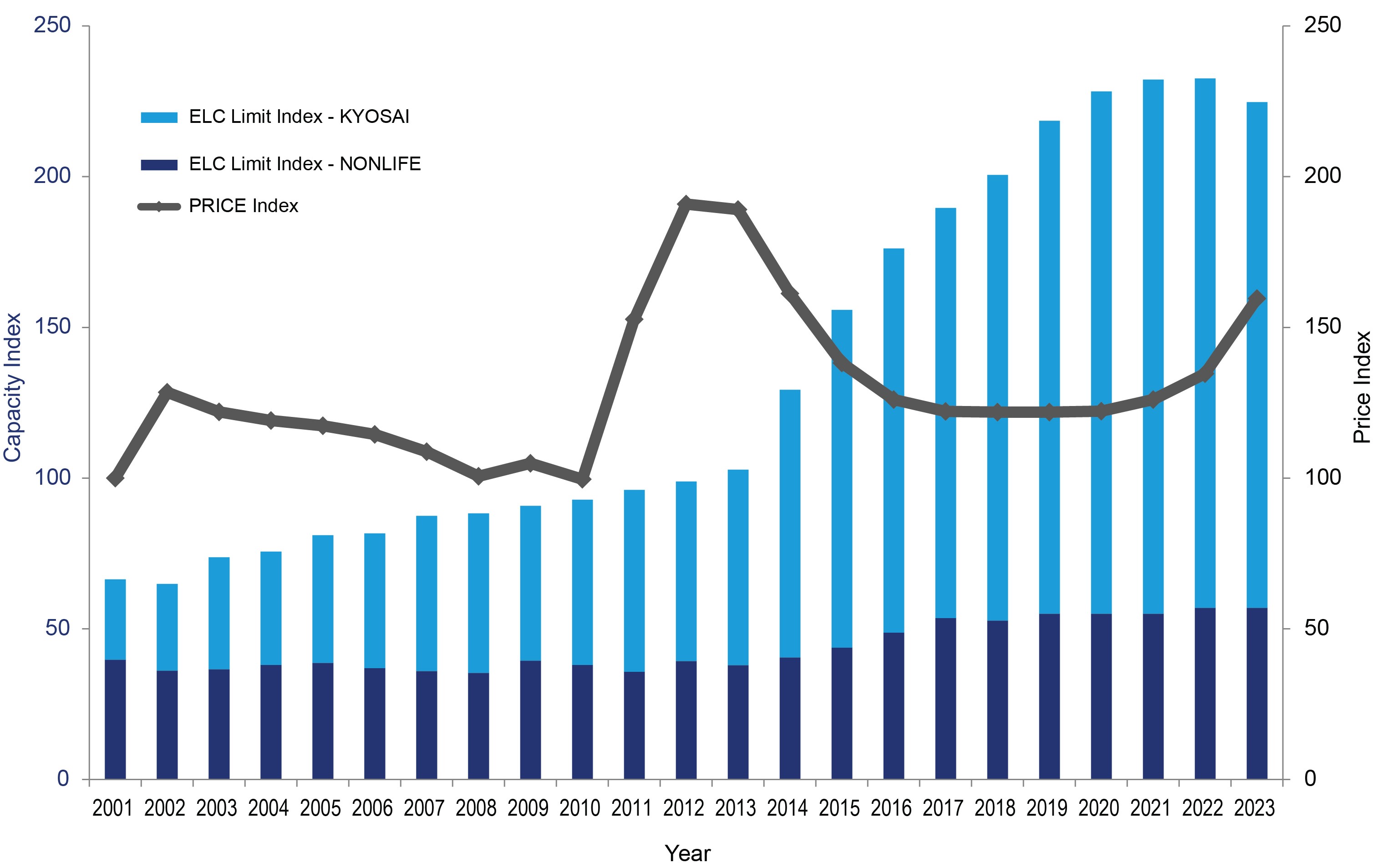

Market Earthquake Excess of Loss Capacity and Pricing: Non-Life Companies and Mutuals

Source: Guy Carpenter. Chart shows total earthquake XL price and capacity purchased, including via combined XLs.

Overseas Catastrophe Excess of Loss

This turned out to be an extremely complex and difficult renewal for this sector, with significant rate increases driven by the international market background. Total purchase was reduced in US dollar terms. Marketing was very difficult, with geographic scope, coverage extent, attachment level and pricing all requiring detailed negotiation on a per-reinsurer basis.

Aggregate Excess of Loss

Less capacity was sought in this segment. Layers brought to market for renewal offered significant price increases and improvements in treaty terms for reinsurers. Marketing was very difficult.

Earthquake Pro Rata

Renewals were stable in this class, which is a popular one with reinsurers. Commissions also were stable. Treaty metrics continued to improve.

Catastrophe Bonds

Catastrophe bonds are used to a certain extent by Japanese buyers to diversify their sources of capacity. There were no Japanese catastrophe bonds issued in FY 2022-23, although for the first time a retrocessional catastrophe bond exposed to Japanese typhoon was issued in June 2022 by a reinsurer buyer. Contrary to the catastrophe bonds issued by Japanese primary insurers, which tend to use an indemnity trigger, the new bond made use of an industry loss trigger. The bond was for USD 150 million. Rates for catastrophe bonds are similar to those in the traditional market, and total limit supplied by this form of capacity remains small as a percentage of the overall limits purchased.

PROPERTY PER RISK

Property Pro Rata

Following a profitable 2021, the market also returned a positive result in 2022, although it was somewhat less positive due to the impact of the Toyota Motors South Africa loss. The market continues to concentrate on rebuilding the positive balances that dissipated greatly during the loss years of 2018 and 2019. Expiring reinsurers mostly maintained capacity at similar levels to previous years. However, there were some reinsurers that exited the class or demonstrated reduced appetite due to these treaties being catastrophe exposed, which resulted in pressure on some placements.

Property Excess of Loss

The global per risk XL market was already firming during 2022, following a run of generally poor results for the class as a whole. Underlying reinsurance market conditions for the 2023 renewal, along with the exit of some reinsurers from the class, put even further pressure on per risk excess of loss pricing, even on loss-free treaties. The total premium spend for the market as a whole increased by over 50% year on year. Coverage conversations took some time, therefore making marketing complex.

CASUALTY

Personal Accident

This represented a challenging renewal, following losses related to COVID-19-related claims. Price rises were significant (range: +20% to +60%), and there was a change in the makeup of the reinsurance panel following a difficult marketing exercise.

Liability

Buyers approaching the market at April 1 faced the hardest market conditions seen for several years. US and pharmaceutical exposures remain the most important drivers of this market. Rates were up by 12% to 15%. Although capacity was down overall, there was just enough to meet buyer requirements.

Engineering

Reinsurer capacity for Japanese engineering pro rata treaties has become increasingly tight in the past few years, and these contracts were difficult to place for the 2023 renewal. To reach maximum placement, clients had to make significant improvements to terms and conditions, as well as having to leverage relationships they had on other lines of business. There were multiple changes to structures, terms and conditions, all designed to narrow coverage. Notwithstanding these facts, a number of reinsurers who had had sizeable shares of the business reduced or did not renew their participations for 2023.

Cyber

The renewal for proportional cyber treaties was uneventful, and expiring terms were generally maintained unchanged from the previous year.

Credit and Bond

These classes remain popular with reinsurers, and ample capacity was available. Cedents were able to use shares in these treaties as incentive to reinsurers that offered support in other, harder-to-place lines.