Hurricane Otis caused tremendous damage in Mexico in October 2023, quickly accelerating from a tropical storm to a category 5 hurricane. Insurers authorized to cover catastrophe risks as part of their property business must create a statutory catastrophe reserve. When an applicable catastrophic event occurs and affects an insurer’s property portfolio, the statutory cat reserve can be released and used to fund claims not covered by proportional and non-proportional reinsurance. Accordingly, as the statutory cat reserve is acting like reinsurance, its depletion should be considered along with other factors when designing optimal reinsurance structures.

Recap of Hurricane Otis—from Tropical Storm to Category 5 Hurricane in less than 24 hours

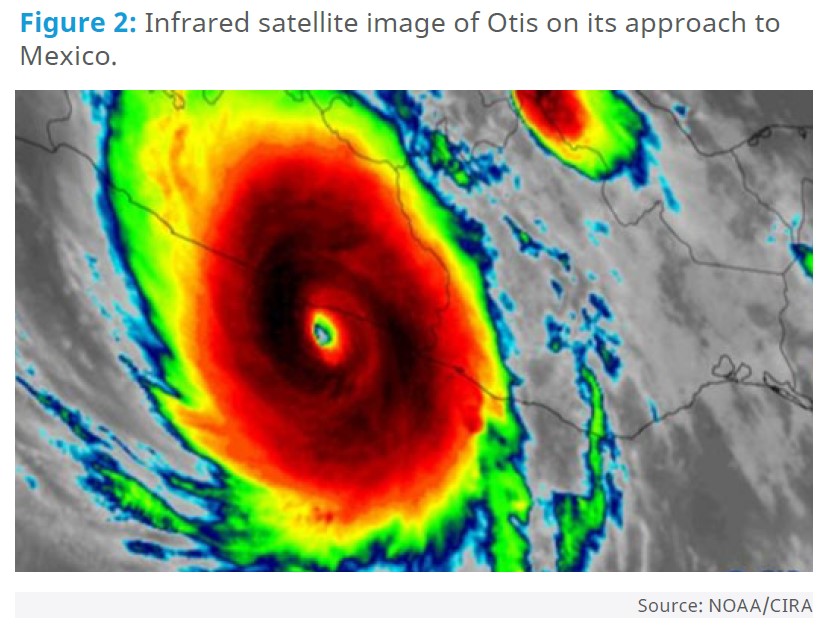

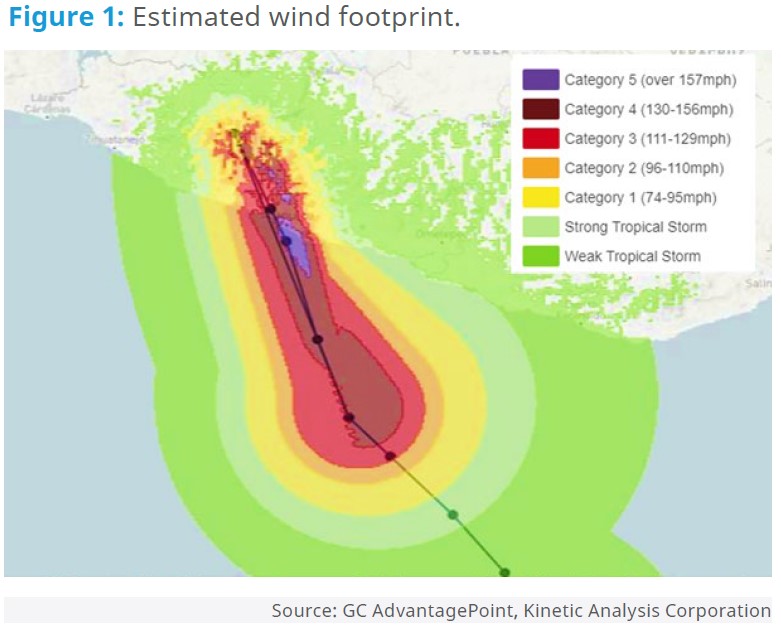

Forming several hundred miles south of the Gulf of Tehuantepec, Otis was named the 15th tropical storm of the Pacific hurricane season on October 22, 2023. By noon on October 24, it had intensified to a Category 1 hurricane. From that point, it rapidly intensified by 3 p.m. to a Category 3 and by 8 p.m. to a Category 5 hurricane.

Otis made landfall in Acapulco Bay early October 25, 2023, with sustained winds above 260 km/hour, where it knocked down hundreds of power line poles, uprooted trees, caused flooding and landslides, and damaged hotel buildings, houses, vehicles, and small and large businesses located in both the Acapulco Bay and the Diamond area.

Impact of Hurricane Otis on the Mexican Insurance Industry

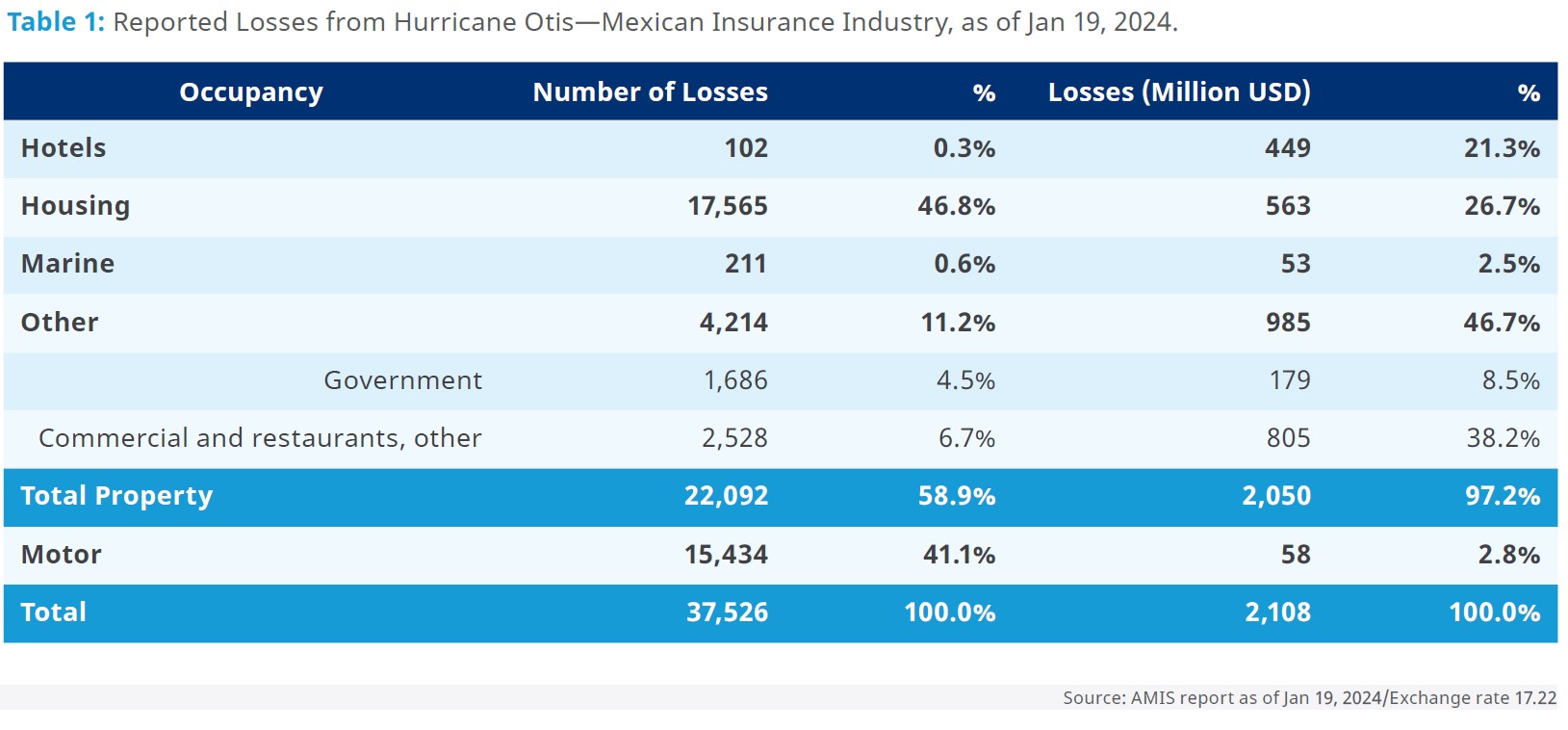

According to the Mexican Association of Insurance Companies (AMIS) report as of January 19, 2024, 59% of claims correspond to property insurance and 41% to motor vehicles. 97% of the reported losses correspond to property insurance damages, while only 3% corresponds to motor vehicles.

Hurricane Catastrophic Risk Reserve and Other Hydrometeorological risks (Statutory Cat Reserve)

Companies authorized to insure catastrophe risks as part of their property business must create a statutory cat reserve. The statutory cat reserve is funded monthly, based on the expected catastrophe loss on a net of proportional reinsurance basis considering a return period of 1,500 years for the perils described in Appendix A.

Funding for the statutory cat reserve has a limit equivalent to 90% of the average of the last 5 years’ probable maximum loss (PML), net of proportional reinsurance, coinsurance and deductibles. Under this methodology, the balance of the statutory cat reserve for the industry as of September 2023 amounted to USD 1.33 billion.

When an applicable catastrophic event occurs and affects an insurer’s property portfolio, the statutory cat reserve can be released and used to fund claims not covered by proportional and non-proportional reinsurance. The release can occur automatically for reported losses derived from the occurrence of any of the perils mentioned in Appendix A.

However, with prior regulatory approval and subject to guidelines and limits, the release can also occur for other items such as:

- Non-payment by any other insurer or foreign reinsurer due to insolvency situations.

- The cost of excess of loss reinsurance coverage reinstatement, when an exhaustion is caused by the applicable catastrophe losses.

- To compensate for the increased cost of excess of loss reinsurance coverage, when according to the point of view of regulators, there is a generalized hard market international reinsurance in the fiscal year in question.

Potential Reinsurance Planning Impact from a Lower Statutory Cat Reserve

An insurer may consider exposing a portion of the statutory cat reserve in the design of its catastrophic excess of loss reinsurance program. However, the unexposed part of the statutory cat reserve cannot be less than the estimated cost of the reinstatement of non-proportional reinsurance contracts. Thus, as insured losses caused by Otis may result in a reduction in the statutory cat reserve for an insurance company, the net financial protection in place for catastrophic losses will also be impacted.

Due to its flexible nature, the statutory cat reserve provides protection for both loss frequency and severity protection. In that sense, it acts more like a proportional contract than an excess of loss contract. As such, the decrease in a statutory cat reserve may make proportional reinsurance more attractive to cover the coverage gap left by a smaller statutory cat reserve.

In summary, the decrease in cat reserve balances should be considered alongside catastrophic modeling results, underwriting strategies, reinsurance pricing, and the impact on key performance indicators when designing optimal reinsurance structures and strategies.

How Guy Carpenter Can Help

Guy Carpenter would be pleased to support you in this evaluation process, by analyzing the impact on catastrophe reserves and the way to use them in your next catastrophe renewals for upcoming seasons.

Appendix A: Perils considered within the category of hurricane and other climate risks

Regulation in Mexico through that country’s insurance and surety law establishes that “hurricane and other climate risks” are understood to be the occurrence of each of the following events:

a) Mud avalanches: Mudslide caused by floods or rains.

b) Hail: Atmospheric precipitation of water that falls strongly in the form of hard, compact ice crystals.

c) Frost: Climatic phenomenon consisting of the unexpected drop in ambient temperature to levels equal to or lower than the freezing point of water in the place of occurrence.

d) Hurricane: Flow of water and air of great magnitude, moving in a circular path around a low-pressure center, on the sea or land surface with peripheral speed of direct impact winds equal to or greater than 118 kilometers per hour, having been identified as such by the National Weather Service.

e) Flood: The temporary accidental covering of soil by water as a result of deviation, overflow or breakage of the retaining walls of rivers, canals, lakes, dams, ponds and other reservoirs or water currents, natural or artificial.

f) Rain flooding: The temporary accidental coverage of soil by rainwater as a result of the unusual and rapid accumulation or displacement of water caused by extraordinary rainfall that reaches at least 85% of the average maximum of the area of occurrence in the last 10 years, eliminating the maximum and minimum observed, measured at the nearest meteorological station.

g) Swell: Alteration of the sea that manifests itself with an over-rise of its level due to a depression or meteorological disturbance that combines a decrease in atmospheric pressure and a shear force on the sea surface produced by the winds.

h) Sea shock or tsunami: The violent agitation of the sea waters as a result of a shaking of the bottom that raises its level and spreads to the coasts, giving rise to floods.

i) Snowfall: Precipitation of ice crystals in the form of flakes.

j) Stormy winds: Winds that reach at least the category of tropical depression, tornado or grade 8 according to the Beaufort scale (62 kilometers per hour), according to the National Meteorological Service or records recognized by it.

k) Any other peril that is part of the risks covered in hurricane insurance.

References

Mexican Association of Insurance Institutions (AMIS). Otis Market Report, as of December 8, 2023. https://sitio.amis. com.mx/

National Metereological Service. Otis satellite images, October 22-25, 2023. https://smn.conagua.gob.mx/es/

National Insurance and Bonding Commission (CNSF). Single Insurance and Bonding Circular. www.cnsf.gob.mx

Guy Carpenter CAT Resource Center, Post Event—Hurricane Otis. Nov. 1, 2023. https://www.guycarp.com/insights/2023/11/post-event-hurricane-otis.html

For more information, contact Israel.Aviles@guycarp.com

Para mayor información, contactar a Israel.Aviles@guycarp.com