Capabilities

Global Capital Solutions

Guy Carpenter’s Global Capital Solutions Unit, comprised of GC Securities, Global Risk Solutions, and Capital & Advisory, helps clients determine the best strategy and portfolio from our full range of financial solutions including catastrophe bonds, insurance-linked securities, debt and equity issuance and M&A. Our professionals have extensive backgrounds in finance and capital markets.

The Capital Solutions Unit works seamlessly with Guy Carpenter reinsurance broking teams globally to add catastrophe advisory, capital-raising, M&A advisory, enhanced and traditional analytics, rating agency advisory, capital optimization and business intelligence.

GC Securities

Market-leading team for all aspects of insurance-linked securities, collateralized reinsurance, surplus notes, private credit and reciprocal exchange formations.

GC Securities provides P&C (re)insurance clients with alternative reinsurance and other capital solutions, including insurance-linked securities, collateralized reinsurance, surplus notes, private credit, and reciprocal exchange formations. Additionally, GC Securities advises on mergers, acquisitions and divestitures in partnership with the Capital & Advisory group. GC Securities provides full-service advisory to its clients throughout the transaction including structuring, marketing, negotiating, signing and funding of the deals.

The GC Securities* team complements our reinsurance brokerage colleagues to extend the range of risk-transfer solutions and advisory services for clients. We are a market-leading team for all aspects of insurance-linked securities and other private capital solutions.

Contact GC Securities For More Information

Market-leading team for all aspects of insurance-linked securities, collateralized reinsurance, surplus notes, private credit and reciprocal exchange formations.

Addressing Your Most Complex Risks

GC Securities continues to be an industry leader in analyzing, structuring and marketing insurance-linked securities (ILS) that deliver optimal solutions for unique risk transfer needs. In addition, GC Securities is the leading advisor on privately placed surplus notes for the P&C insurance sector. The team is comprised of vastly experienced corporate finance experts in a variety of ILS offerings, such as catastrophe bonds, sidecars, collateralized reinsurance, ILWs and insurance-linked notes, as well as surplus notes, reciprocal exchange formations and M&A.

GC Securities Areas of Expertise

The Clients We Serve

Recent GC Securities Transactions

$175 million 144A industry loss index catastrophe bond for a French reinsurer

$420 million 144A indemnity catastrophe bond for a specialty insurance carrier

$1.1 billion 144A indemnity catastrophe bond for a Florida residual market insurer

$100 million 4(a)(2) surplus note for regional P&C insurer

$210 million 144A indemnity catastrophe bond for a Florida-based private insurance carrier

$103 million capital raise and formation of an insurance reciprocal exchange

Global Risk Solutions

The Global Risk Solutions team are specialists in structured and capital-oriented reinsurance including legacy transactions, start-ups, M&A, solvency relief, rating agency relief and other complex situations.

The team is comprised of the most experienced and qualified structured reinsurance professionals in the reinsurance industry, including qualified actuaries, CPA's, former underwriters, ex-buyers of reinsurance. This team is responsible for creating some of the most innovative and proprietary products on behalf of our clients.

Contact Global Risk Solutions for more information

Specialists in structured and capital-oriented reinsurance including legacy transactions, start-ups, M&A, solvency relief, rating agency relief and other complex situations

Structured Products & Innovative Risk Transfer Solutions

Structured products frequently achieve broader protection and rating agency goals at a more favorable cost/benefit ratios than conventional options. We analyse risk, structure/design transactions and quantify the impact of the solution on company’s financial statements and capital models, including the AM Best BCAR model, the NAIC RBC model, Solvency II and others.

Our team conducts modelling that helps clients determine the optimal solution to achieve their financial goals, while remaining within their risk tolerance thresholds. After designing and modelling the solution, transactions are executed in the most efficient and effective marketplace.

Our Solutions Include

Prospective Covers

Retroactive Covers

Life & Annuity

Recent Global Risk Solutions Transactions

Type: Multi-Year Cat • Motivation: Captial/Earnings Protection

Type: Whole Account Stop Loss • Motivation: Capital/Earnings Protection

Type: LPT • Motivation: Exit From a Business

Type: QS • Motivation: Captial

Type: PPR • Motivation: Capital/Earnings Protection

Type: LPT/ADC • Motivation: Business Restructuring

Capital & Advisory

Guy Carpenter’s Capital & Advisory team combines seasoned M&A and capital-raising advisory expertise with a leading global broking platform. We provide insurance clients with an integrated set of strategic and risk advisory services to address their most complex business challenges and opportunities.

Contact Capital & Advisory for more information

Guy Carpenter’s Capital & Advisory team combines seasoned M&A and capital-raising advisory expertise with a leading global broking platform

Strategic Partner to the Insurance Industry

- Partners with reinsurance brokers to deliver holistic and creative solutions to their clients

- Boasts a deep domain expertise across the (re)insurance landscape, including M&A execution, capital raising, strategic advice and business planning

- Composed of seasoned investment bankers with extensive, pure-play insurance expertise across insurance subsectors, geographies and transaction types

- Focused on delivering independent, conflict-free advice and long-term success of our clients

- Global presence and offices in key US/UK (re)insurance hubs with access to best-in-class insurance expertise

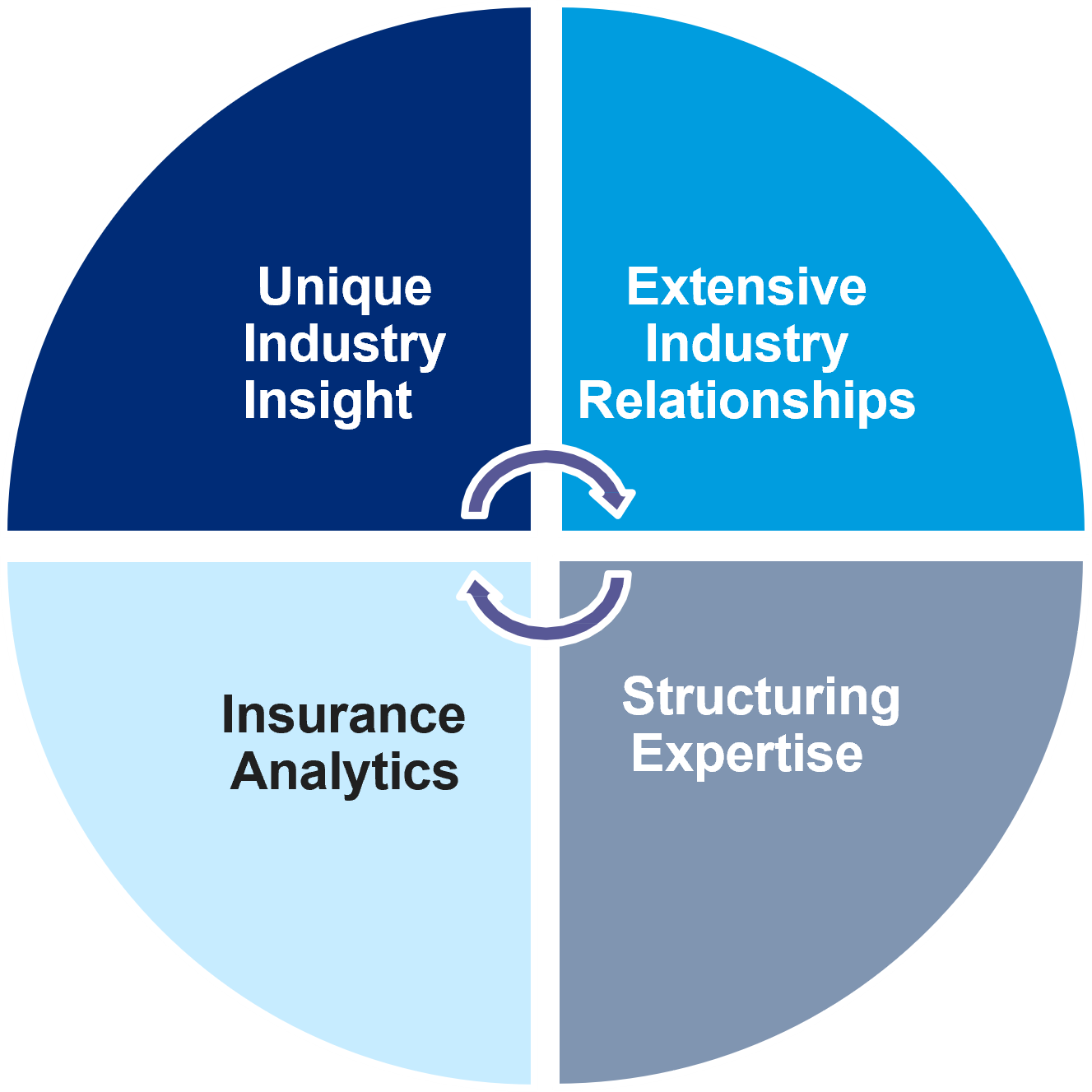

Strategic partner to the insurance industry which combines unique industry insights, relationships, analytics and transaction structuring expertise

Capital & Advisory is fully integrated into Guy Carpenter

Access at the highest level to many insurers, reinsurers and insurance investors globally

Industry-leading analytics

Experienced banking team dedicated to the insurance sector

Recent Capital & Advisory Transactions

$70m Capital Raise / Start-up. Sole financial advisor to a parametric insurance company.

$1.1bn of capital raised through an IPO. Financial advisor to a leading reinsurance carrier.

$400m equity investment by group of investors. Financial advisor to an insurance carrier.

Strategic advisor to an employee benefits provider on strategic alternatives regarding their LTC business.

Strategic advisor to a large life insurance company on portfolio optimization alternatives.

Strategic advisor on M&A-driven growth alternatives for a leading P&C insurance carrier.

Get the Latest News and Insights from Guy Carpenter

* Securities or investments, as applicable, may be offered in the United States through GC Securities and/or GC Capital & Advisory, each a division of MMC Securities LLC (“MMCS”), a U.S. registered broker-dealer and member of the Financial Industry Regulatory Authority (“FINRA”), the National Futures Association (“NFA”) and the Securities Investor Protection Corporation (“SIPC”). Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000.

Securities or investments, as applicable, may be offered in the United Kingdom by GC Securities a division of MMC Securities Ltd. (“MMCSL”), which is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN.

Securities or investments, as applicable, may be offered in the European Economic Area (“EEA”) by GC Securities, a division of MMC Securities (Ireland) Ltd. (“MMCSIL”), which is authorized and regulated by the Central Bank of Ireland, reference number C447471. Main Office: Charlotte House, Charlemont Street, Dublin 2, D02 NV26, Ireland.

Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC.

For further legal and regulatory disclosures relating to MMC Securities, including the business continuity plan disclosure, please click here.