Capital Management

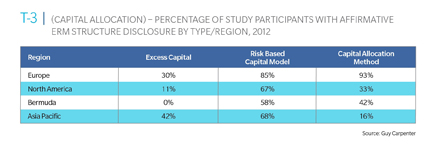

Capital management using risk-based capital models and capital allocation is a central component of risk management practices. We have investigated this topic as a new chapter for our 2013 ERM Benchmark update. In this context, Table 3 shows the portion of companies that publish concrete data on their excess capital - the amount of capital retained in excess of a certain target amount. Table 3 also shows both the portion of companies using risk-based capital models in the risk management process and the portion giving some indication of the methodology of the capital allocation process.

Observations

The companies from our sample are generally developing their own risk-based capital models that need approval from either risk committees or authorities and external independent third parties.

- Capital allocation methods are usually described with their related value at risk measures. Common methods include co-measures of risk, premium-to-surplus ratios and proportional allocation.

- In all territories the disclosure level for the excess capital is quite low. Companies appear to be reluctant to show the exact level of their economic excess capital. They usually refer to their excess capital as a proxy that provides reassurances about their risk levels without explicitly reporting it. For instance, for some companies, the disclosed information refers to a general solvency level: "The excess of capital is double the minimum solvency risk margin imposed by regulators..."

- Nearly all Bermudian companies publish details about their repurchase program for their own shares. If we interpret this as information about excess capital, the zero percent would change to a much higher number.

Conclusions and Outlook

Even though ERM implementation practices are disclosed at higher levels in the European market, we can observe that ERM practices are increasingly well integrated within companies' general management practices all over the world. The improvement in disclosure levels observed in the past three years clearly shows that a rapid evolution is underway. For instance, the disclosures on ERM governance have already reached an adequate level in all markets, illustrating the focus on well integrated ERM cultures. Attention is now shifting toward more technical aspects and a general focus (especially in Europe) on capital models and operational risks.

We noted in our previous briefings that we anticipate that regulatory, capital market and legislative influences would quickly push company managements to better recognize the risks of their enterprises. We again conclude that increasing external demands will drive (re)insurers to recognize the value of metric-based ERM frameworks and capital models in evaluating risks. The main external factor will be the final implementation of Solvency II in Europe, which has been announced for 2016. As Solvency II is the worldwide example for a holistic risk regulation framework, combining both quantitative and qualitative aspects of risk management, it is likely that insurance regulators outside of Europe will adopt many parts of Solvency II. Also, the further requirements of International Financial Reporting Standards, which focus on market-consistent valuation of insurance liabilities and globalization of the insurance market - together with rating agency pressure - will force companies to improve the quality of risk management disclosure, especially towards corporate quantitative goals and risk strategy.