Asia Pacific is a diverse mix of countries encompassing nearly one-third of the earth's landmass and more than one half of its population. Given the broad spectrum of economic and regulatory sophistication across the region, the approach to insurance regulation has varied on a country-by-country basis as each regime adapts solvency principles to their own needs and political realities.

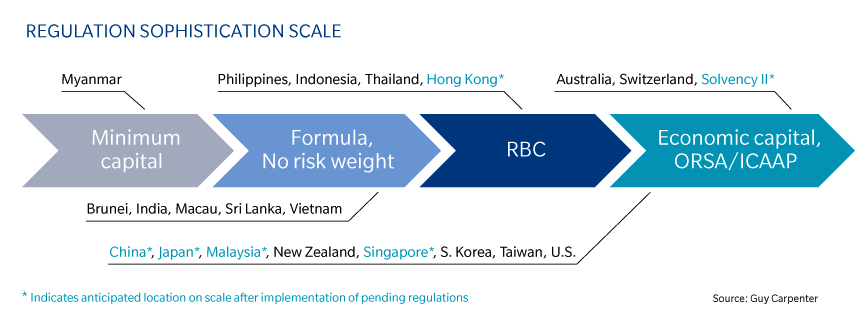

Directionally, most country regulators are taking steps to build more robust regulatory and solvency frameworks (see the figure below):

- South Korea, Taiwan and Malaysia are in their second round of risk-based capital (RBC) schemes - Japan is in its third round.

- Australia and Malaysia have implemented Internal Capital Adequacy Assessment Process (ICAAP) requirements and Singapore is implementing an ORSA framework.

- Australia, Indonesia, Japan, the Philippines, Taiwan and New Zealand have specific catastrophe risk-related solvency requirements.

- Japan is seeking third-country equivalence status for Solvency II for reinsurance business. China, Hong Kong and Singapore have also expressed interest.

- Hong Kong is incorporating the International Association of Insurance Supervisors' Insurance Core Principles into its first RBC framework anticipated in 2018.

- China's Insurance Regulatory Commission (CIRC) is instituting sweeping changes through its three tiered China Risk Oriented Solvency System (C-ROSS) framework that will dramatically impact how (re)insurers conduct business. C-ROSS and its anticipated changes are explored more deeply later.

While these evolving quantitative and qualitative reporting requirements are burdensome for local Asia Pacific (re)insurance companies (particularly during the first few iterations), they help regulators more effectively monitor solvency, which can lead to more resilient markets and improved underwriting discipline.