Other countries, such as the Philippines and Indonesia, have instituted rules that may, conversely, impede the development of a healthy, profitable insurance market. The Indonesian regulator's recent steps to reduce capital outflows, with a focus on reinsurance premiums ceded to international reinsurers, remain highly debated and will be explored in greater detail later.

The Philippines, in addition to a risk-based capital (RBC) framework, has instituted a minimum paid-up capital requirement (starting in 2006 and revised in 2013) that increases every two years and will result in a PHP2 billion (approximately USD44 million) minimum threshold in 2020. This will put minimum capital levels in the Philippines well above those of more developed markets, including Australia, Japan and Singapore. The policy applies uniformly across the industry regardless of premium volume, line of business or geographic scope and therefore its impact is more strongly felt by smaller carriers that will most likely be forced out of the market or into the arms of larger players. The Philippines Insurer and Reinsurer Association (PIRA) has been outspoken against the minimum capital requirement and stated a preference for a standalone RBC metric.

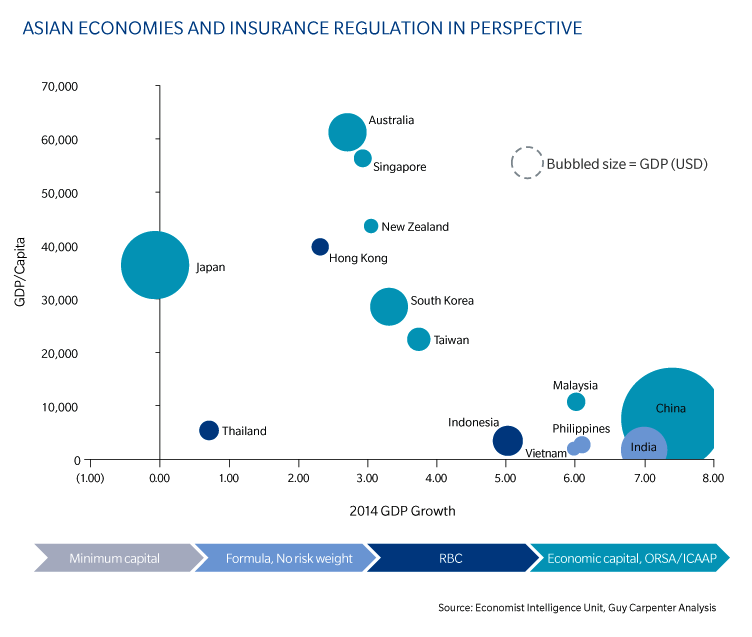

Generally, the more advanced economies across the Asia Pacific region have robust insurance regulatory frameworks.

With the exception of Hong Kong, each country with a gross domestic product (GDP) per capita over USD10,000 has, or is, moving towards an economic capital and/or Own Risk and Solvency Assessment (ORSA)/Internal Capital Adequacy Assessment Process (ICAAP) requirement. In less developed countries, the focus continues to be on educating consumers on the value of insurance and increasing insurance penetration.