Andrew Cox, Managing Director; Matthew Eagle, Head of GC Analytics - International and Eddy Vanbeneden, Managing Director

On January 1, 2016, the Solvency II regulatory regime took effect. Some celebrated; others were weary from the months and years of preparation.

But, to borrow a turn of phrase from Winston Churchill, this is not the end of Solvency II, it is not even the beginning of the end, but it is the end of the beginning.

The impact of Solvency II goes well beyond its strict regulatory assessment. Solvency II creates an environment for greater risk-driven management of the (re)insurance companies doing business in and with Europe.

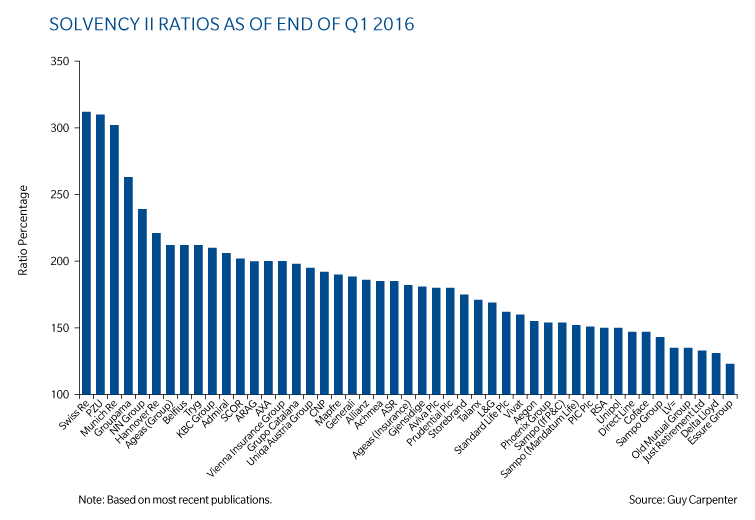

While the solvency capital requirement (SCR) and minimum capital requirement are the thresholds used by regulators to trigger action on specific entities, the solvency ratio (own funds over SCR) is fast becoming an important metric for comparing companies.

Many companies publish their solvency ratios without being required to do so, and some others actually specify target solvency ratio ranges as part of their risk appetite and financial targets.

Solvency ratios are another metric for investors to use when assessing the relative financial strength of companies - and (re)insurance buyers can do the same when assessing counterparty risk.

Some larger quoted companies use the capital regime to strengthen their self-regulation. By setting target ranges and minimum levels well above 100 percent, these companies create their own parameters for self-intervention in instances when they will buy back shares or simply cut the dividend. We have seen examples of companies recapitalizing after their SCR moved below a minimum range, illustrating the focus investors may start to have on this metric.

However, the effectiveness of a single ratio as the basis of comparisons should not be overstated. For example, how comparable is a standard formula-based ratio to one calculated on an internal model? What about different use of transitional arrangements, or matching adjustments? As Solvency II is still being introduced at different rates, various stakeholders have to pay attention to individual company standards for reporting solvency ratios.

Volatility

Another shortcoming of a single ratio is that it provides no insight into the resilience of an entity's capital position. This became relevant when market volatility spiked in the first quarter of 2016 and companies disclosed how much their Solvency II ratios fell in the period.

This environment produced varying outcomes in the first half of 2016, with an additional sharp increase in volatility caused by catastrophe losses. Timely and accurate reporting of this volatility has increasingly become a management responsibility.

Today, reinsurance as an alternative form of capital is more at the center of risk management. Insurers have increased efforts to understand and quantify all material risks and are using reinsurance not only as a tool to manage capital and their SCR ratio, but also to manage earnings volatility as reflected in their risk appetite statements and risk tolerance levels.

Risk Management and Risk Profile

With the transition from Solvency I to Solvency II, insurers have to contend with a more complex and comprehensive risk management framework than just premiums and reserves. This new framework encompasses the full range of risks exposing a (re)insurance portfolio, including an examination of existing risk mitigation frameworks.

Insurers are more heavily focused on reviewing their diversified risk profile with more active risk and portfolio management, with each portfolio segment examined on its own merit.

The stronger focus on risk management is pushing (re)insurers to review the varying contributions to capital needs and earnings. For those companies that have decided to develop an internal model, the alignment with all requirements can be challenging. There is a need to provide a clear view of the risk for a range of risk classes not just limited to the most obvious.

Solvency II is not limited to the calculation of the required capital. It creates an environment for a more global and robust approach to risk, from risk selection and pricing to capital needs and allocation.