Jeff Krohn, Managing Director and John Tedeschi, Managing Director

The global financial crisis of 2008 exposed the US mortgage industry, taxpayers and the global capital markets to the full loss potential of residential mortgage credit risk. A total shakeup of the US housing sector was the result: a return to prudent underwriting criteria; market standardization in product; Private Mortgage Insurer Eligibility Requirements (PMIERs); and a Federal Housing Finance Agency (FHFA) directive that mandates government sponsored entities (GSEs) Fannie Mae and Freddie Mac to begin transferring credit risk on the hundreds of billions of dollars of US mortgages issued each year.

"Mortgage credit risk" is the risk of borrower default on a loan. In the context of a (re)insurance transaction, a default produces a loss when the net resale value of a property after legal and foreclosure costs is less than the mortgage balance held by the lending institution.

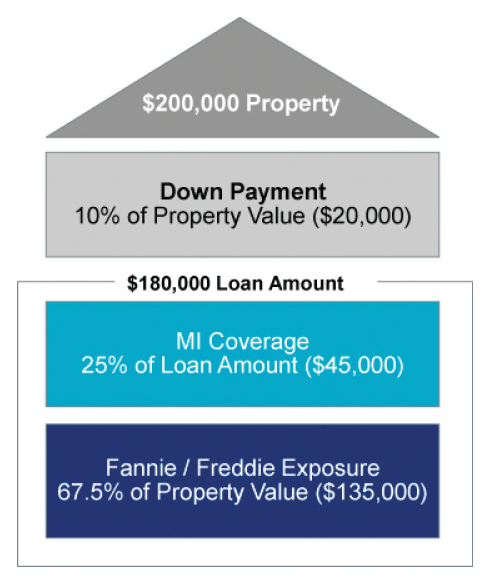

The graphic below illustrates a USD 200,000 single family dwelling where the buyer places 10 percent down on the property and takes out a loan on the outstanding home value in the amount of USD 180,000. The bank requires the purchase of private mortgage insurance (PMI), which covers the lender's first loss position when the buyer's down payment is less than 20 percent of the home value.

In the United States, mortgage credit risk (re)insurance is purchased by PMIs and GSEs. PMIERs became effective on January 1, 2016, and govern the capital standards by which PMIs must comply. As permitted in other global solvency regimes, reinsurance is an allowable capital management tool in the United States; it is recognized as capital on the PMI's balance sheet, and is a lever that several PMIs have employed.

Beginning in 2013, the GSEs began purchasing various credit risk transfer (CRT) products from the global capital and (re)insurance markets. The FHFA mandate stipulates that Fannie Mae and Freddie Mac must transfer a significant portion of their mortgage credit risk to private counterparties. In doing so, the GSEs reduce taxpayer exposure, minimize fluctuations in the availability of homeowner credit, create market efficiencies and oversights and build a consistently liquid market for US single family credit risk.