Jeff Krohn, Managing Director and John Tedeschi, Managing Director

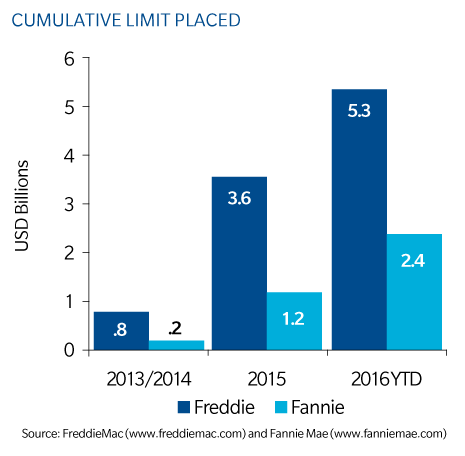

(Re)insurance markets sold close to USD 8 billion of government sponsored entities (GSEs) mortgage credit risk transfer from 2013 to 2016 year-to-date, with significantly more planned on a consistent basis. A robust global credit risk transfer market is now in full-effect; recent transactions include the Credit Insurance Risk Transfer and Agency Credit Insurance Structure (re)insurance purchased by Fannie Mae and Freddie Mac, and capital bond issuances from Fannie Mae's Connecticut Avenue Securities and Freddie Mac's Structured Agency Credit Risk

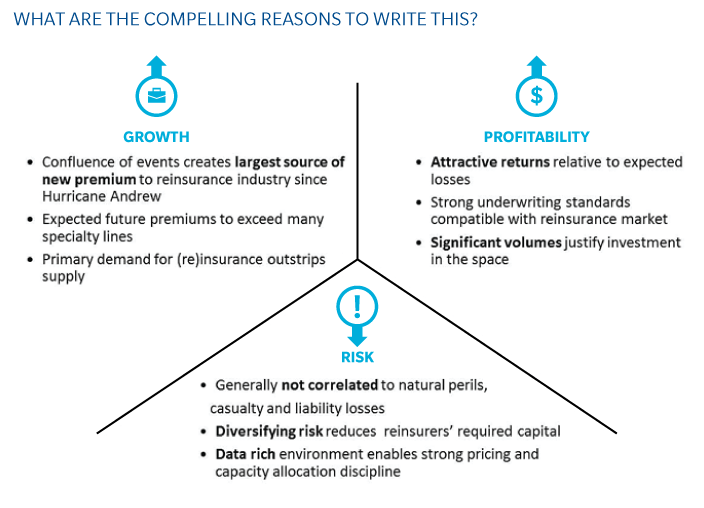

The GSEs are continuing to expand the use of alternative capital and include the use of (re)insurance to hedge their risk as mandated by the federal government. The GSEs continue to expand portfolios that need to be (re)insured and are seeking new capacity to expand their massive needs. The US housing market is one of the largest industries in the world. As (re)insurers seek opportunities to grow, profitably, the residential mortgage credit risk market provides portfolio diversification, underwriting and capital management benefits - the risk is uncorrelated to the majority of property/casualty (P&C) lines of business and (re)insurers may participate in layers of reinsurance that match their risk-return appetite.

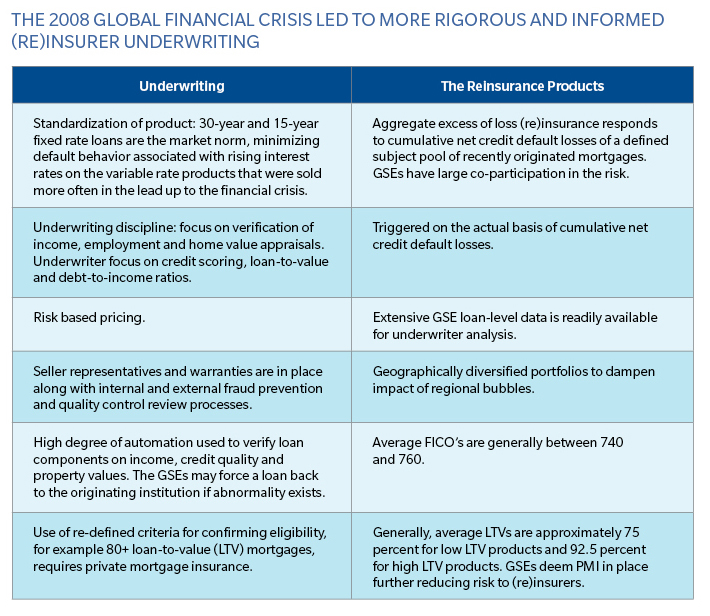

The strong underwriting discipline in all facets of the US mortgage system has dramatically reduced credit risk. The macro-economic forecast for this sector is positive, given the diverse US economy, low interest rates and limited housing supply. The GSEs are committed to a consistent issuance of debt or (re)insurance hedging strategies. Guy Carpenter provides guidance to clients around participation in mortgage credit risk transactions. We encourage clients and prospects to reach out to our team of specialists.