Thomas Hettinger, Managing Director, Strategic Advisory

- There are indications that new A.M. Best Stochastic Based BCAR factor assignments may require more capital for companies entering a new line of business than for established writers growing in that line

- Companies will be under extra pressure to choose growth strategies carefully because of potential capital pressures from A.M. Best and their potential for low returns due to the extended soft positions of many markets

- With current capital positions evaluated, robust and current market insight is critical to accurately assess potential growth areas

Initiatives for insurers' profitable growth in 2018 will come with significant challenges and considerations for management. Stochastic Based BCAR and an extended soft market teetering on change will require insurers to evaluate growth objectives carefully.

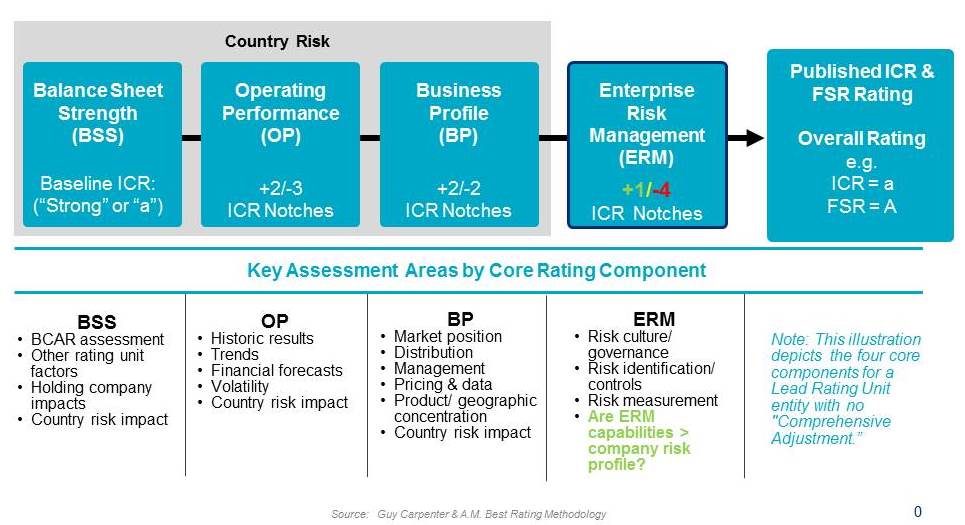

"A.M. Best will place new demands on how growth of a company is evaluated through its recently implemented Stochastic Based BCAR and rating framework," says Thomas Hettinger, Managing Director, Strategic Advisory, Guy Carpenter. "There are indications that new BCAR factor assignments may require more capital for companies entering a new line of business than for established writers growing in that line. Another development in the new A.M. Best Ratings framework escalates the need for adequate enterprise risk management (ERM). Strong ERM may qualify for a one notch upgrade, while an inadequate finding allows an analyst to drop a company's rating up to FOUR levels. Companies will need to pay careful attention to matching operational controls and ERM to growth initiatives."

Stock companies will face different challenges than mutual companies, but both will be under extra pressure to choose growth strategies carefully because of the combination of budding capital pressures from A.M. Best and their potential for low returns due to the extended soft positions of many markets.

"To respond to these challenges, insurers will need to evaluate not only their balance sheet capital, but also all of their other capital positions and their corresponding strengths and weaknesses," he adds. "These include intellectual capital, human capital, operational capital and brand capital. Companies that can manage risks and tap available capacity in as many of these pillars as possible will have the greatest opportunity for effective growth plans. This should be a part of the ERM process - risk mitigation techniques should be discussed around the whole plan, including reinsurance solutions as a core lever. Reinsurance solutions can either be done on a prospective or retrospective basis and many companies are using loss portfolio transfers and adverse development covers to manage overall balance sheet capital when evaluating the risk/return benefit of a new growth opportunity.

"Reinsurance can also provide strategic access to additional human and intellectual capital and/or operational platforms to support entering new lines of business or solving emerging challenges."

He continues, "With current capital positions evaluated, robust and current market insight is critical to accurately assess potential growth areas - areas for consideration should include past profitability, the current rate environment and regulatory and judicial pressures. Evaluating past company performance in a given market segment is also important, but is only a start to understanding how a company may perform once it is structurally prepared to enter a new segment. Additional areas for evaluation should focus on assessing how the addition of a new segment impacts volatility in profitability; evaluating the potential for correlated risk drivers with the current book; and understanding where potential policyholders reside."

Even after the most careful analysis and planning, profitable growth requires active oversight and management. Hettinger explains, "Companies that understand their capital in all forms, that can articulate a strategy around where and how they want to grow, and that regularly monitor emerging results relative to their risk tolerances will position themselves for success with all their stakeholders - including effective communication with rating agencies."