- Increased computing power is fueling innovative solutions for flood underwriting

- Insurers are using technology to communicate a homeowner’s flood risk with mobile apps

- Guy Carpenter works extensively with most commercial vendor flood models

Flood risk and its impact on communities are global concerns. Advances in data quality coupled with expanding model development and computational power leads to increasingly accurate risk evaluation for (re)insurer portfolio analyses and underwriter risk analyses – with a concomitant increase in policyholder risk awareness. Guy Carpenter and sister company Marsh are harnessing new tools to facilitate clients’ risk management decisions surrounding this challenging peril, according to Elizabeth Cleary, Managing Director, Guy Carpenter.

Increased computing power combined with affordable data storage and near instantaneous data transfer is fueling innovative solutions for flood underwriting. “Elevation data, arguably the most critical piece of information for understanding flood, is advancing in accuracy and resolution; geographic information systems are allowing instantaneous quantification of flood risk characteristics such as distance to potential flooding sources; and remote sensing and imagery services are enabling more reliable collection of building characteristics such as first-floor height above ground,” Cleary explains. “In addition, mobile technology is allowing self-reporting of critical pieces of information and consistency-checking against third-party data sets. These pieces of information are now a few clicks away, empowering underwriters to confidently select risks that optimize their portfolios.”

Policyholders are also benefiting from the advances in technology. Cleary adds, “One of the reasons homeowners do not purchase flood insurance is that they do not believe they are at risk; after significant U.S. events a realization of lack of insurance take-up consistently emerges. Insurers are beginning to utilize technology to communicate a homeowner’s flood risk through mobile applications and to simplify the processes required to secure insurance. Elevation information, flood risk scores, flood maps and localized claims information are examples of the types of data available to consumers and insurers for improved risk management. The U.S. Federal Emergency Management Agency has outlined a ‘moonshot’ goal to double insurance penetration in the United States by 2023 – through the National Flood Insurance Program (NFIP) coupled with private sector flood initiatives. To reach this goal, processes must be simplified so that agents and insureds can better recognize flood risk and obtain coverage.”

Cleary mentioned that Guy Carpenter is focusing resources and investment around flood risk issues to support clients’ ability to operate more effectively in this space. “Examples include:

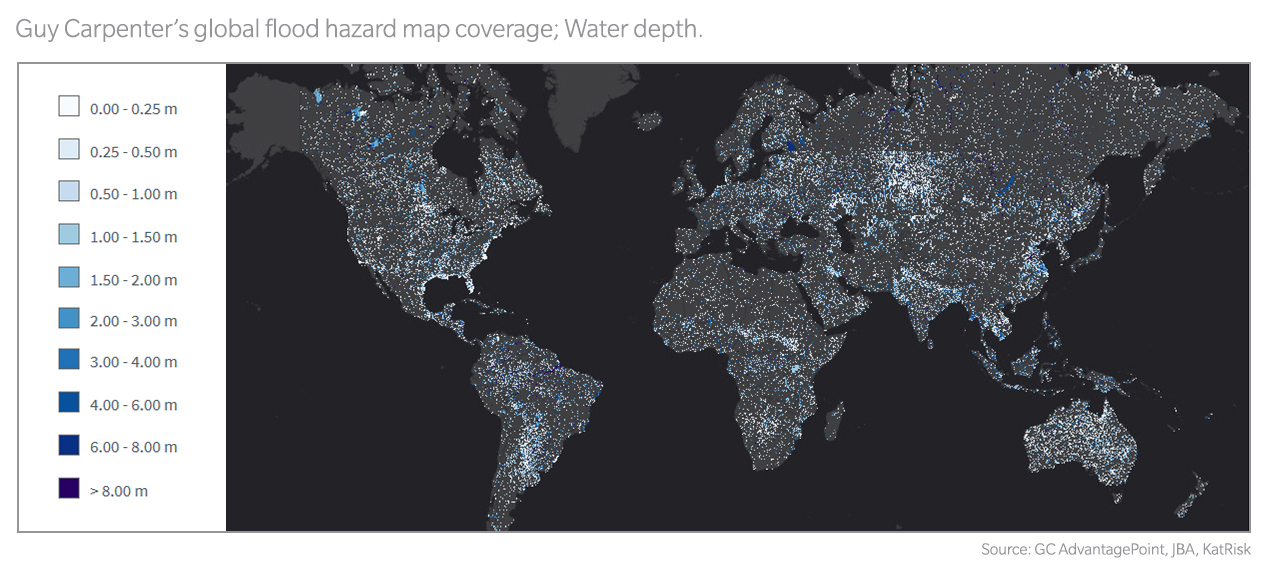

- Model evaluation and development: Guy Carpenter works extensively with most commercial vendor flood models and can perform vigorous validation exercises with clients that empower them to make the most intelligent risk decisions. Where vendor models do not exist we have built flood models (covering Canada, Asia-Pacific and Europe) for the benefit of our clients. In the process, we source a vast array of data from third-party vendors that is used to supplement commercial models by providing additional views on flood hazard, vulnerability and exposure data.

- GC AdvantagePoint®, our seamless platform for incorporating additional data sources, provides flood hazard data intersected with client exposure – is another Guy Carpenter solution. Marsh’s Risk Consulting group offers a wide array of visual intelligence tools for pre- and post-event risk mitigation.

- We are heavily engaged in building functional public-private partnerships to improve flood risk management – including on-going engagements with Flood Re in the United Kingdom and NFIP in the United States. Both engagements involve significant modeling and actuarial support in enhancing risk management strategies designed to maintain and build private sector (re)insurance to support the needs of local communities.”

“Regardless of the market segment – insureds, carriers, reinsurers or brokers – it is clear, advances in data and analytics have elevated the industry’s ability to make sound risk selection and protection decisions for flood risk,” Cleary says. “Whether flood solutions are sought for local risk evaluation, portfolio management or risk transfer, Guy Carpenter continues to explore and develop tools, assess sources of data and evaluate models on behalf of our clients and the industry.”