- Rising loss costs and expenses consume an ever larger portion of reserves

- Optimized portfolio construction as vital as upfront underwriting of a risk

- Excess capacity is pressuring insurers’ underwriting profitability

Today, (re)insurers are challenged by a host of factors pressuring companies’ earnings and capital – excess capacity is impacting underwriting profitability as claim frequency and severity are rising – contributing to a movement toward balance sheet volatility that impacts earnings and growth, according to a global roundtable of Guy Carpenter leaders.

With abundant capital levels already putting downward pressure on underwriting profitability, in-flows of new capital continue at record levels. “Capital markets investors continue to flock to the sector following the loss events of 2017. Alternative capital, which rose to 20 percent of total dedicated reinsurance capital at year-end 2017 according to Guy Carpenter, paid losses as expected,” says Jay Dhru, Global Head of Business Intelligence. “Lost capacity was quickly restored, demonstrating investors’ commitment to the asset class and proving its reliability. Questions remain on the long-term impact of alternative capital on the competitive position of insurers.”

Insurers are seeing positive earnings growth following a ten-year run of lower than normal catastrophe activity, further buoyed by prior period reserve releases. “Insurers may have been over-relying on reserve releases, so caution is needed in an environment of rising loss costs and expenses that consume an ever larger portion of reserves,” explains Matthew Day, Managing Director.

Simultaneously, the accumulation of reserve risk from long-tail lines and the impact of inflation on prior years is a material threat to financial results and contributes to volatility. Companies may be pressured to reserve to their “base case” or less because of competition. Some companies may be holding back on releases in case trends worsen or because their reserve cushions are shrinking.

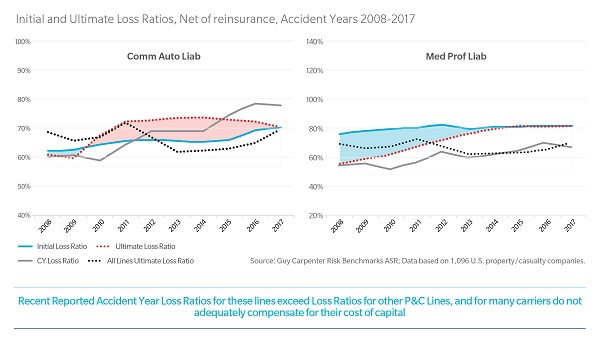

“Increasing cost of claims coupled with a rapid rise of severity contributes to balance sheet volatility, raising the possibility that excess capital may in fact not be at ‘excess levels,’” adds Jack Snyder, Managing Director, Ratings Advisory. “Increases in severity in 2017/2018 contributed to continued unprofitable underwriting results in liability lines across medical, commercial auto and other liability occurrence. The rise in severity is likely to endure and can no longer be treated as one-off events. The increase in large jury awards also influences growing claim severity with a risk of a concomitant increase in frequency. Increasing rates of inflation may also grow claims costs, further burdening balance sheets.”

More intense weather patterns may be contributing to the uptick in frequency and severity. “Wildfire events in EMEA and California and the quick-changing 2017 path of Hurricane Irma in Florida are clear examples of events that could happen again,” Day relates.

Insurers’ loss costs are rising faster than rates. Today, insurers deal with a scenario where earnings do not exceed the cost of capital on a normalized basis for reserves and catastrophes.

“There are solutions for (re)insurers that turn these challenges into opportunities,” Snyder says. “A strategy that optimizes portfolio construction is just as important as upfront underwriting of a risk.” Dhru mentions that the use of new solutions and capabilities built on sophisticated data analysis is critical to growth. These new data-powered capabilities and tools allow insurers to gain market insights around risk and capital decisions and improve operational efficiencies.

“Guy Carpenter Global Strategic Advisory provides solutions to optimize clients’ capital and reserves,” Snyder says. “Strategically examining legacy liabilities to separate the liabilities that should remain on the books from those that are better aligned with adverse development covers or introducing aggregate stops are options.”

Managing capital strategically may include implementation of reinsurance solutions. “Guy Carpenter works with clients to create tailored reinsurance covers that match insurers’ capital and risk levels for maximum efficiency,” Dhru concludes. “We help clients manage frequency and severity with strategic solutions that reduce the dependence on capital needed for long-tail lines of business. These solutions offer greater certainty in financial results, enhancing companies’ long-term earnings and opportunities for profitable growth.”