Motor insurance is the most widely purchased property and casualty product in Europe and represents an important platform in the region for both traditional and non-traditional products, managing general agents, captives and other affinity and distribution platforms, according to Federico Camera, Managing Director, Guy Carpenter and Pawel Koszorek, Senior Vice President, Guy Carpenter.

In 2017, motor insurance premiums grew for the third year in a row at a rate of 4.2 percent year-on-year, reaching a record EUR 138 billion. Most European markets contributed to this, including the top three territories by premium income: Germany (+4 percent), France (+2.7 percent) and the UK (+8.3 percent). Furthermore, some smaller motor markets have experienced strong growth, including Poland, Slovenia and the Czech Republic.

A key factor in the market’s evolution has been revisions to the legal system for assessing bodily injuries as a result of road accidents and an overall positive trend in road safety.

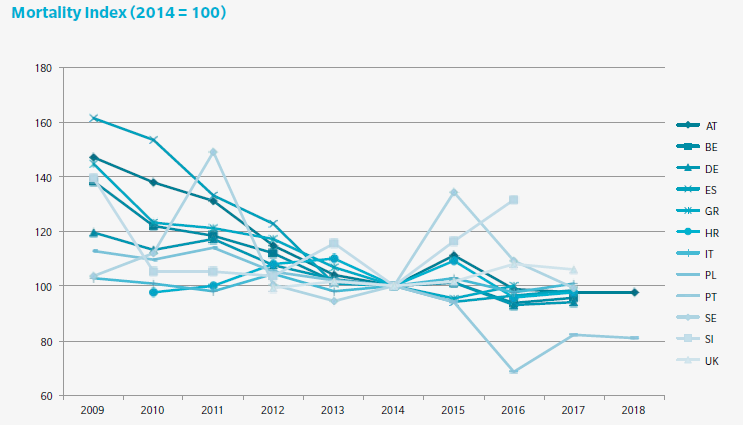

Looking at the extreme entries in the Mortality Index chart, we note:

• Portugal currently has the lowest index value; despite a 4 percent increase in the number of fatalities for 2017, the number of claims increased (above 7 percent) resulting in a reduction in the index.

• The highest index value is currently recorded by Slovenia. The index has fluctuated over the past decade, but when examined in detail the improvements are vast, as the number of fatalities has reduced by 53 percent and accidents by 42 percent.

• Sweden shows the greatest reduction since 2014. The Swedish government has a long-term zero vision for road accident mortality and investments are made in road safety actions and speed limits.

Source: National Statistical Records

Market statistics show a trend towards reduced claims numbers but increasing claims costs. This is due, in part, to improved driver assistance technology and more road safety initiatives, offset by more expensive vehicles and parts.

The insurance industry is constantly innovating to better meet evolving consumer demands. The European Commission initiated a review of the Motor Insurance Directive in 2016 through various consultations, with proposed revisions including the standardization of claims history statements. Future technological developments should allow claims histories to be integrated with additional information such as driving behaviors.

Legislation protecting injured parties across the territories is undergoing significant change, leading to larger claims both for physical damage and bodily injury. In most instances, these are borne by the reinsurance market. At the same time, motor insurers are seeing an increase in the Solvency Capital Requirement allocated to motor due to the increased weight of reserving risk for claims.

While studies have shown that there is no strong correlation between the share of motor third party liability (MTPL) in a company’s portfolio and its Solvency Ratio, on average the greater the share of MTPL in a portfolio the lower the Solvency Ratio. Due to the relatively high capital requirements of MTPL and reduced diversification, the difference between companies with a small MTPL portfolio and a large one can be as much as 70 percent.

In response to these challenges, Guy Carpenter’s EMEA Motor Study provides clients and reinsurance partners with an overview of this peril throughout the region. The 2019 edition has an enlarged territorial scope, including Israel for the first time. The study also includes external contributions from major players in the motor industry both from the insurance /reinsurance sector and from within the automotive industry.

Note:

Guy Carpenter would like to thank:

- BMW and Swiss Re for their overview of the Advanced Driving Assistance Systems;

- The DRÄXLMAIER Group, a leader in production of components for the electrification of cars, for their view on the megatrends that will determine future mobility; and

- Unipol Group, a telematics insurance leader in Europe, for insight into the impact of black boxes on Motor insurance portfolios.