The societal, operational and human costs associated with COVID-19 are prominent in our thoughts, discussions and efforts. While these costs are undoubtedly high, health insurers and reinsurers are also closely monitoring the direct and indirect financial impact of the virus. The growing use of telemedicine and capacity constraints within our healthcare system will potentially dull utilization increases; however, the financial costs will still be significant.

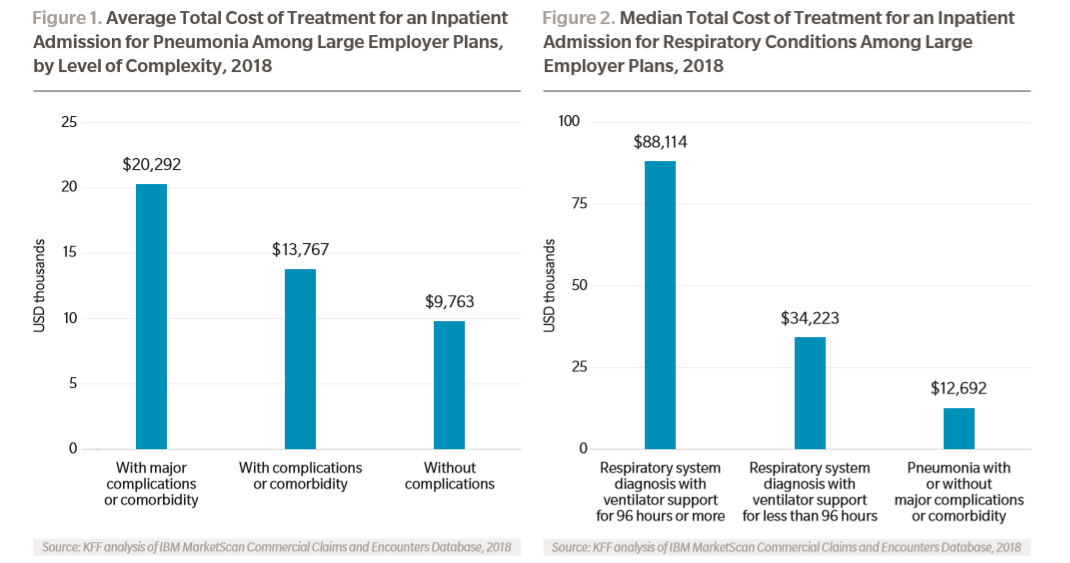

Examples of the types of direct insurance claims associated with COVID-19 include testing, doctor and emergency room visits, hospital admissions, stays in intensive care units and end of life care. As shown in Figure 1, the insurance costs in the United States associated with an inpatient hospital stay for pneumonia (a common complication from COVID-19) range from nearly USD 10,000 to over USD 20,000 (in 2018 dollars), depending on the length of stay, geography, coverage type and comorbidities of the patient. While the exact cost of testing for COVID-19 varies, according to FAIR Health, for patients not requiring a hospital stay, the costs for flu testing and accompanying doctor visits can range from USD 200.00 to USD 500.00. (1) While less common, severe cases of COVID-19 may develop into acute respiratory distress syndrome (ARDS), costing health insurers hundreds of thousands of dollars per member.

For patients who require more extensive treatment, including with a ventilator, costs are much higher. As shown in Figure 2, costs for treatment with a ventilator can range from USD 34,000 for ventilator support of less than 96 hours to USD 88,000 for ventilator support for more than 96 hours.

There are also a number of indirect medical cost considerations. For example, health insurers offering administrative services only and employer stop loss products may be exposed to increased credit risk should employers not have available funds for paying employer claims or premiums. This risk would appear to be greatest for small employers, potentially blunting the increase in credit risk exposure, as small employers are more likely to purchase fully insured plans. Health insurers are also keeping an eye on the proportion of members seeking out-of-network care, which could lead to increase costs for both the insurer and member. Increased out-of-network utilization may result if individuals become sick while self-isolating in rural areas or not returning home because of travel concerns.

There is growing encouragement from governments and healthcare providers to postpone elective surgeries. Eliminating non-essential surgeries allows hospitals to re-allocate their resources to better manage a surge in patients needing medical care resulting from contracting COVID-19. Should this trend continue, and it appears it will, health insurers may benefit from a near-term decrease in utilization from other-than-COVID-19 diagnoses, partially offsetting the increased utilization resulting from the pandemic.

Footnotes:

- Business Insider

Click here to read the report >>

Click here to register to receive email updates >>