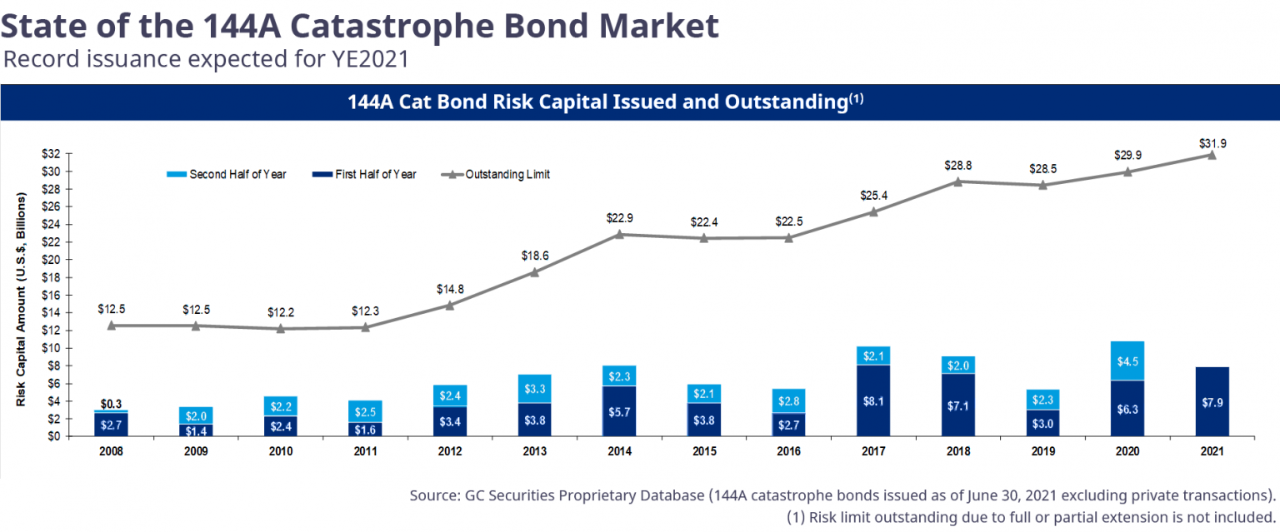

As risks in the reinsurance world have grown more complex and investors are seeking greater yields, the 144a catastrophe bond market is on track for a record issuance year in 2021. In the first six months of the year, USD 7.9 billion in new bond issuance entered the market, via 27 unique transactions for 26 different sponsors.

First-time sponsors include reinsurers, Florida domestic carriers, mutual and corporate insurers. The bonds are also popular with public entities and risk pools, including the Federal Emergency Management Agency (FEMA), Florida Citizens and the Texas Windstorm Insurance Association (TWIA).

More and more reinsurers are exploring this market as an efficient substitute for retrocessional capacity through aggregate industry index-based structures. In addition to the flexibility these bonds help provide to carriers, investors like them as well, for a wide variety of reasons.

• 144a catastrophe bonds cover more remote risk and that coverage is on a named-perils basis, which provides a level of predictability.

• Structuring, modeling and disclosure provided for catastrophe bonds add to their transparency and robustness as investments.

• Tradability of these instruments mitigates collateral trapping concerns.

• They have performed predictably both during the current COVID-19 pandemic as well as throughout their 25-year history.

While the 144a market is primarily property catastrophe-focused, the sidecar market has expanded into the casualty and legacy runoff spaces. There was also some issuance of extreme mortality and morbidity bonds during the first half of 2021, which shows that investors are willing to accept such risks if these are properly structured to be index-based or on a stop-loss basis. Investors continue to be very cautious on cyber risk in view of the increasing frequency and potential systemic correlation issues.

Alternative capital has also started to pick up Environmental, Social, Governance (ESG) credentials, which are in high demand from assets managers, especially in Europe. The first green catastrophe bond was sponsored this year, and it was extremely well received by investors. ESG specialist funds have also started to include ILS as a potential investment category.

Both traditional and alternative capital can expect to see continued growth and evolution to support individuals, businesses and public entities who are facing increasingly complex risks across the world.

Click here to register to receive e-mail updates >>

Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities LLC, a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the United Kingdom by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities LLC, MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh McLennan. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product.