Property/casualty (P&C) insurers of all sizes may benefit from scenario testing, helping them understand how different stresses can affect their financial performance–and therefore their long-term strength and stability, which is critical to their ability to serve policyholders. The National Association of Mutual Insurance Companies (NAMIC) has joined forces with Guy Carpenter to release the Scenario Testing Our Mutual Future report. GC’s BenchmaRQ capital modeling tested how a set of pre-defined stress scenarios could affect the performance of every US P&C company. This report indicates that the US P&C industry is well capitalized, with most insurers fully prepared to ensure even a severe scenario. However, a harsh recession or the impact of inflation could pose potential risks.

Scenario Testing Our Mutual Future

FOREWARD

In a world forever changed by the COVID-19 pandemic, mutual property/casualty insurance companies of all sizes are facing increasing pressure from stakeholders to consider the impact of systemic scenario testing on their financial forecasts. Understanding how the many different scenario tests can impact their financial performance is critical to their long-term strength and stability, which, in turn, is critical to each mutual company’s ability to serve its policyholders.

In support of this consideration, NAMIC and Guy Carpenter have collaborated to develop a series of reports designed to measure the exposure of each U.S. property/casualty (P/C) insurance company to a set of pre-defined operating environments. From 2021 through 2023, the two will investigate how various scenarios, expected and unexpected, will impact mutual companies.

To help contextualize the analysis for NAMIC member companies during this three-year period, NAMIC has defined cohorts of companies based on company structure, size, business profile, and regional footprint. This prospectively focused research is designed to arm companies with information on a range of “what if?” scenarios and position them to compare the impact on their own financial performance to that of their peers. The 2021 report and subsequent updates summarize industry and segment-level results and provide readers practical guidance on how to use these scenarios tests to help better measure, manage, and mitigate risk.

This critically important research is expected to provide a realistic assessment of the potential impact of adverse scenarios on profitability and solvency at the industry and company level for every active U.S. P/C statutory entity.

EXECUTIVE SUMMARY

Risk quite literally is the business of P/C insurers. In exchange for a premium, insurers assume significant notional exposure on every policy written. In addition to this underwriting risk, insurers hold investment assets, which can experience considerable volatility in market value. To grow and protect capital over the long term, it isn’t enough to just price each policy appropriately at the time of binding; it also requires a holistic strategy for measuring aggregate exposure across the enterprise and mitigating the chance of any single event leading to a significant drawdown in surplus. To measure exposure across a portfolio of assets and liabilities, many insurers utilize sophisticated capital modeling tools that simulate performance in a range of potential future operating environments. Despite the best efforts of modelers and management teams, events sometimes arise that are outside the range of possibilities contemplated to date. The global COVID-19 pandemic is one such event, the impact of which is still being measured and felt today. This report outlines an approach for combining stochastic capital modeling with discrete scenario testing, which represent potential future events or operating environments, to better understand how well positioned the industry is today to weather these challenges. This research will be updated periodically to ensure the risk measurements provided remain timely and relevant, with new scenarios added as the market landscape changes.

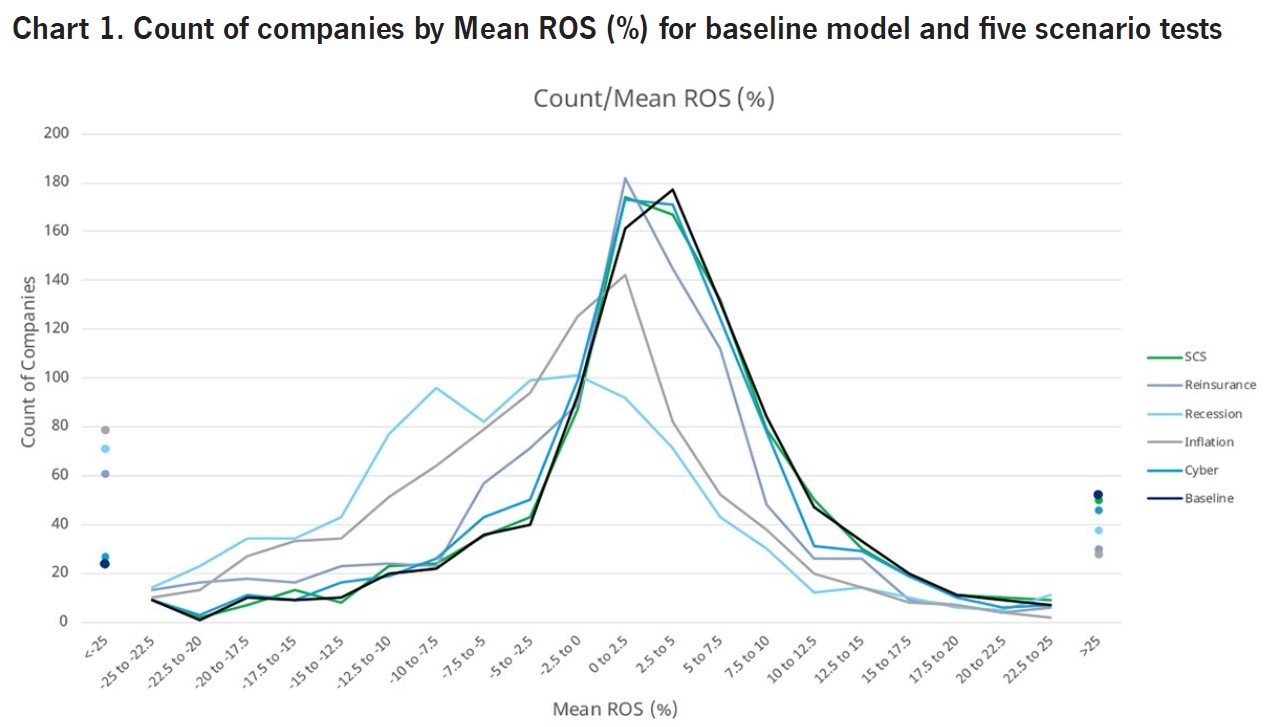

Chart note: Count of companies with return on surplus less than -25% or greater than 25% is shown with corresponding dots on chart to indicate the tail aggregation.

Chart note: Count of companies with return on surplus less than -25% or greater than 25% is shown with corresponding dots on chart to indicate the tail aggregation.

Chart note 2: Mean ROS is defined as mean modeled 2021 change in surplus before impact of dividends or change in paid in capital, expressed as a percentage of year-end 2020 policyholder surplus.

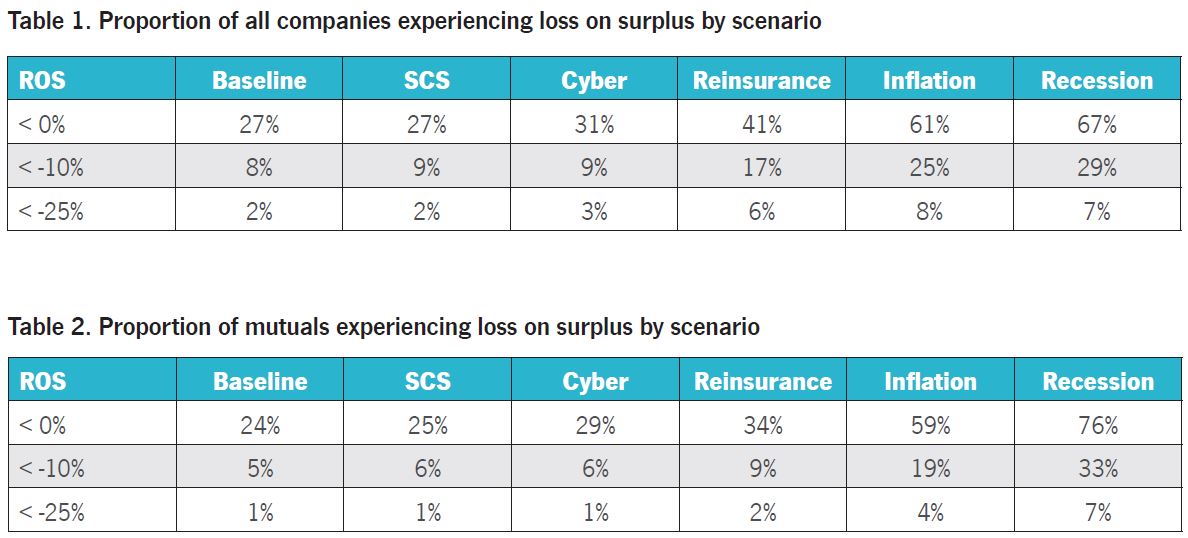

The most important takeaway from this research is that as of today, the U.S. P/C industry is strongly capitalized, with a large majority of insurance companies well positioned to survive even a severe scenario test. For most companies, a harsh recession is the driver of the biggest reduction in surplus. As a result of the bull market in risk assets that has persisted since the 2008 financial crisis, the level of equities and other risk assets on insurers’ balance sheets is the highest it’s been in at least the last 25 years – for every dollar of statutory surplus on insurers’ balance sheets at year-end 2020, 79 cents was invested into public or private equity. This equals 36% of the total cash and invested assets held by the U.S. P/C Insurance industry. For reference, at year-end 2007, just before the sub-prime financial crisis, only 25% of insurers’ invested assets were in equity securities. A similar market drawdown in the coming years would have a significantly greater impact on insurer financials than even the 2008 financial crisis. Mutual companies in particular should monitor their asset exposure carefully, as the scenario testing shows the typical mutual insurer is more exposed to recession risk than an average stock company.

Among those modeled, the next most impactful scenario facing the industry was a sudden spike in inflation. This scenario was particularly severe for companies writing long-tail commercial lines with years of accumulated reserves on the balance sheet. Though the impact was slightly less severe than that of a recession, for the industry as a whole, it results in a greater number of companies facing inviability or outright insolvency. As companies navigate through an environment of historically low yields and quickly rising price inflation across a variety of goods and services, it is critical to re-evaluate exposure to risk of loss costs trending more adversely than planned.

To help understand trends in modeling results across companies, this study used predictive modeling to determine what the greatest indicator would be of a company having high expected volatility and low expected return. Very high reserve leverage was the single most predictive characteristic for company underperformance. In the past periods of reserve strengthening, many carriers were able to absorb the hit to surplus gradually over several reporting years. If a sudden change in claims costs makes a gradual approach to loss recognition unfeasible, many carriers could see significant pressure on their surplus and ratings.

Increased frequency and severity trends in severe convective storm (SCS) activity are scenarios that might reasonably be expected to pose major capital impact for exposed carriers. The authors were surprised to find that even a significant amplification of modeled SCS activity did not materially impact risk profile for the vast majority of companies. The scenario was based on projecting forward the trends observed in more than 60 years of meteorological data and resulted in an industrywide increase in gross annual average insured severe convective storm losses of USD 2.3 billion. Of these additional losses, carriers’ in-force catastrophe reinsurance programs are expected to absorb USD 300 million to 350 million.

These are annual average costs, and the increases in high storm activity years were significantly greater, but also more disproportionately retained by reinsurers than primary carriers. The impact of the SCS scenario on the 1:100 convective storm year is expected to be USD 6.4 billion higher gross loss versus the baseline, which after catastrophe reinsurance would net to USD 3.6 billion of additional retained catastrophe losses. As catastrophe model vendors and reinsurers begin to adjust their expectations for the SCS peril, reinsurance cost may be adjusted to reflect this increased exposure, which will put pressure on carriers to price for true convective storm risk more precisely on a policy-by-policy level.

The quantity and variety of large losses incurred by P/C insurers has significantly reduced returns on deployed capital for the reinsurance industry in total. A multi-year soft market in the mid-2010s reduced rate levels for coverage in many reinsurance markets to near historic lows. Since then, there has been a sudden increase in ceded losses over the past several years, including the emergence of insured perils such as wildfire and cyber.

In response to continued pressure on profitability, AM Best (Best) has warned that companies should consider scenario testing that reflects an increase in the market price of reinsurance capacity. This scenario would test the performance of stock companies significantly more than mutuals in most circumstances. Often, smaller and midsize companies are more dependent on reinsurance to hedge their risk and may not have sufficient capital to maintain operations without continuing to buy cover at higher rates. Companies operating in the southeastern part of the country are also often highly dependent on reinsurance and will be subject to pressure to push the added reinsurance cost over time to the policyholders, if regulators will allow it. .

Awareness of cyber risk faced by companies has grown significantly. From 2015 to 2020, the U.S. market for affirmative cyber insurance has tripled, from USD 1 billion to USD 3 billion, and it continues to grow by more than 30% year-over-year through the first half of 2021. Insurers must manage their exposure to three main types of cyber risks: affirmative, silent, and operational.1 Silent cyber risks in particular present unique risks to insurers due to potential ambiguities in coverage language, resulting in unintended cover. As reinsurers across lines have moved quickly to exclude cyber in the All Other Perils cover, it is incumbent on companies’ legal, underwriting, and management teams to ensure no coverage gap exists between their primary policies and reinsurance protection. There is little doubt this risk will continue to evolve and grow as the multinational backdrop grows increasingly interconnected. Carriers should treat the threat of a systemic cyber catastrophe event impacting a large number of exposures as not a question of “if” but “when.”

We are pleased to share this first Scenario Testing Our Mutual Future report. NAMIC and Guy Carpenter look forward to reader feedback and encourage readers to reach out to the authors with any questions or comments that might help improve the next edition of this report.

METHODOLOGY AND GOALS

The scenario tests began by examining each U.S. P/C company’s 2020 Annual Statement filed with the National Association of Insurance Commissioners. Using Guy Carpenter’s proprietary standardized capital modeling framework, BenchmaRQTM, Guy Carpenter conducted a simulation of future operating results based on underlying risk distributions, including capital market outcomes, insurance market cycles, attritional and large losses, and catastrophic events. These scenarios take into account each company’s own financial history, Guy Carpenter’s insurance risk benchmarks, economic projections from Moody’s Analytics™, and market share-based catastrophe modeling run through AIR™. The output from BenchmaRQ provides valuable insights on a company’s performance across a range of potential scenarios for what the future may produce. Comparing performance across the loss curve with expected results informs a deeper understanding of a company’s loss sensitivities and exposure to different types of scenario testing.

Additional context is provided by comparing a company to its peers or market competitors. In the sections of this report covering each scenario test, we document our rationale and assumptions adopted for modeling the scenario testing.

GOALS OF THE SCENARIO TESTS

Systemic shock scenarios are unpredictable and challenging to forecast by nature, so it is helpful to reference multiple sources when deciding which scenarios to incorporate into the model. Best monitors the solvency and risk profile of most of the U.S. and global insurance markets and has made scenario testing a point of emphasis in its ratings evaluations. Best has put the task of selecting and defining relevant scenario tests onto the management teams of each company, with the goal of reflecting probable and impactful potential exposures and aligning action plans around exposure outside its risk appetite. Regulators in several states, including New York, have begun asking companies to provide enhanced disclosures around cyber risk and exposure to climate change. Additionally, in some cases, boards of directors are reaching out to management for information on risk mitigation strategies across specific areas of interest.

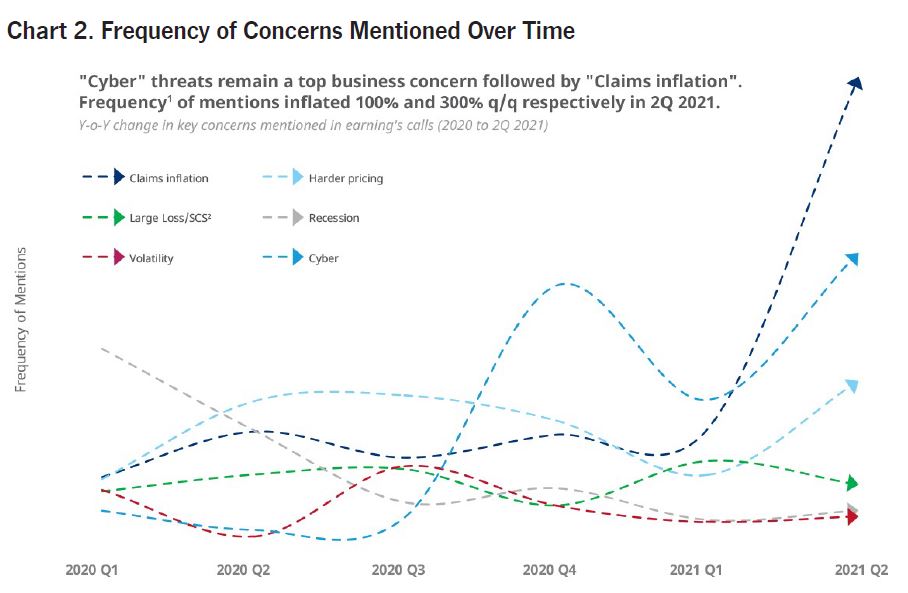

Public stock companies must disclose key risks and emerging threats they are monitoring, and equity analysts will ask questions on facets of the market that may present risk to future performance. Frequency of topic mention trends in investor analyst calls and public communications and disclosures collected from 35 U.S. regional and national publicly traded P/C companies is shown below. Cyber risk increased from the lowest priority in first quarter 2020 to one of the highest in recent quarters. Chance of a recession registered very high on company concerns in second quarter 2020 through the middle of the pandemic-induced lockdown, but recession concerns have since largely abated from the short-term radar of investors and now register among the lowest of tracked risks. Interest in large losses driven by SCS has not surprisingly displayed seasonality, while inflation has risen greatly in prominence recently on the radar of public companies and the analysts that cover them.

Based on the above data and feedback from a range of sources, we selected five scenario tests, which are described in detail in their respective sections in this report. As the road ahead for insurers remains uncertain, NAMIC and Guy Carpenter will continue to develop relevant and impactful scenario testing and provide detailed company-level results of the tests to NAMIC member companies.