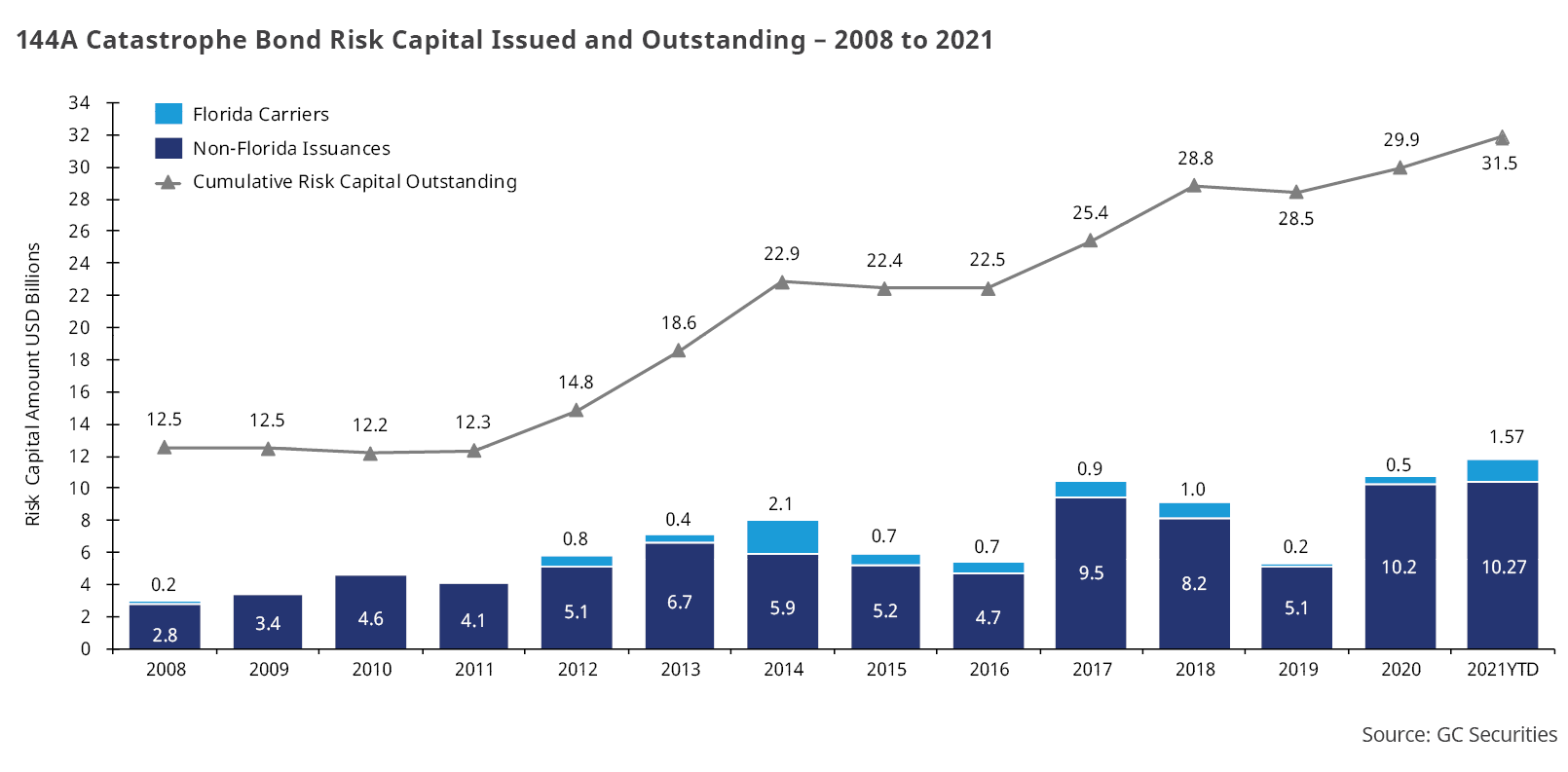

The catastrophe bond sector experienced a record year in 2021. During the year, 45 different bonds were brought to the 144A market for over USD 11.5 billion in limit placed, taking the total outstanding notional amount to over USD 31 billion.

In view of constrained retrocessional capacity, global reinsurers found industry loss index-based multiyear, multiregion and multiperil aggregate covers available in the bond market to be especially attractive. Over 70% of the limit placed had an indemnity-trigger structure, with the balance coming from industry loss index and parametric structures.

Click image below to see enlarged version of the chart

Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities LLC, a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the United Kingdom by GC Securities, a division of MMC Securities Ltd., which is authorized and regulated by the Financial Conduct Authority. Securities or investments, as applicable, are offered in the European Economic Area by GC Securities, a division of MMC Securities (Ireland) Ltd., which is authorized and regulated by the Central Bank of Ireland, reference number C447471. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities LLC, MMC Securities Ltd., MMC Securities (Ireland) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh McLennan. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product.