Climate change and extreme weather are increasingly important for multiple stakeholders, including regulators, rating agencies, investors and risk managers. This briefing examines how climate change affects physical risks posed to insurers with exposure in India and the evolution of regulation associated with this risk.

Introduction

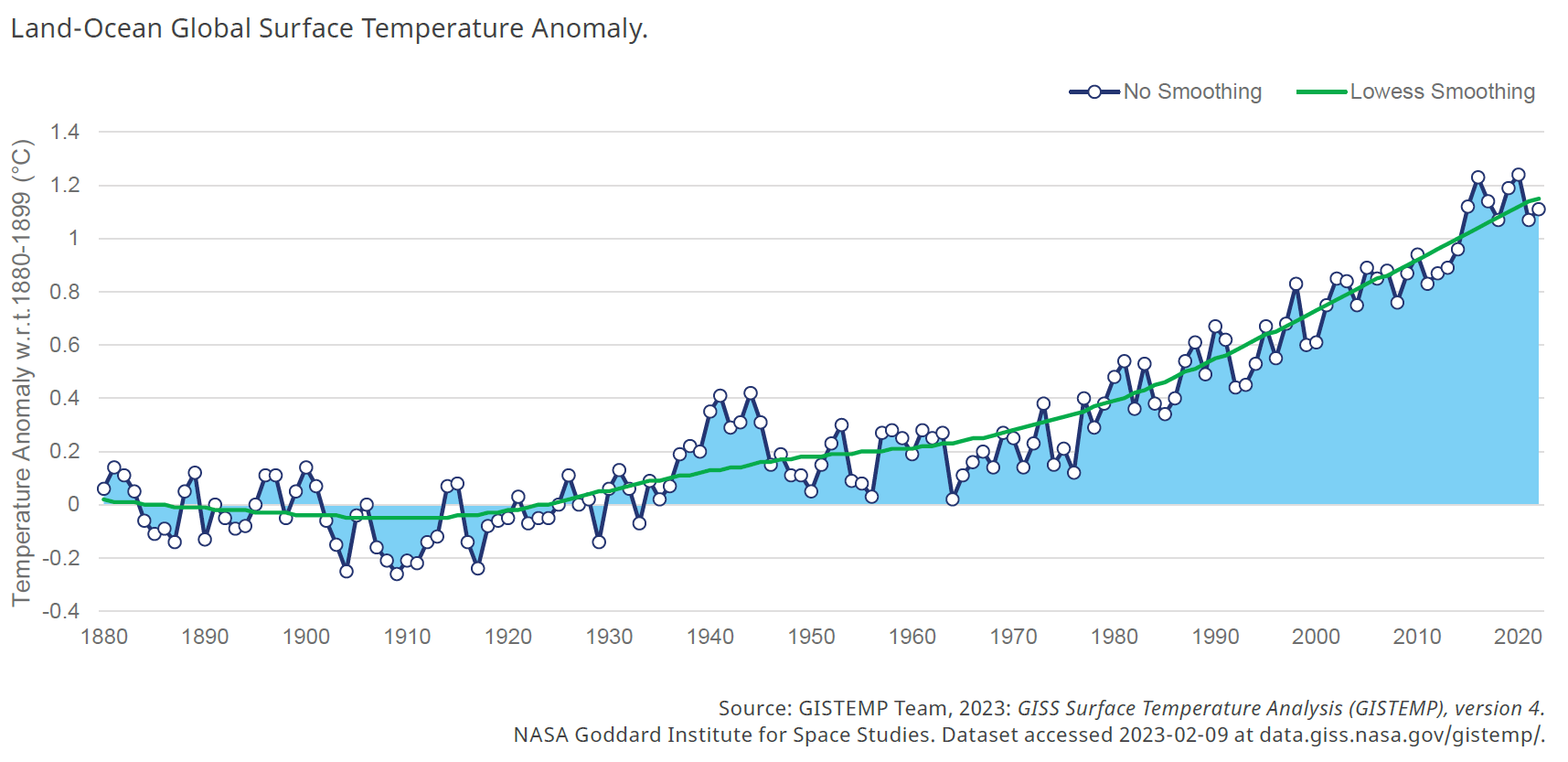

There is increasing pressure on insurers to understand climate change’s impacts on damaging weather. The National Aeronautics and Space Administration (NASA) reported that 2022 was the fifth-warmest year on record, with the average surface temperature 1.11°C warmer than during pre-industrial times.

The global temperature is projected to increase further and will reach 1.5°C around 2030 without a radical reduction in emissions. These seemingly small increases in temperature can have a large non-linear impact on a wide range of perils, from drought to tropical cyclone storm surge. If there are no reductions in emissions in the medium term, then 3°C of warming is likely before the end of the century, which would bring more severe consequences.

The recent deadly heat wave and drought in India (March-April 2022) have been partially attributed to climate change. Analysis shows that climate change increased the probability of such an event by around 30 times. Furthermore, the probability of similar events will continue to increase with additional global warming. (Re)insurers can avoid unexpected losses—and help achieve long-term growth and profitability—by quantifying their exposure to the physical risk of climate change. (See figure below. Click the image to see larger version of the graph.)

Evolving Risk Landscape

The frequency and severity of natural catastrophes are expected to increase due to climate change. The subsequent impact on insured loss is highly dependent on the peril and region of interest, and is described in the section Climate Change Impact by Peril.

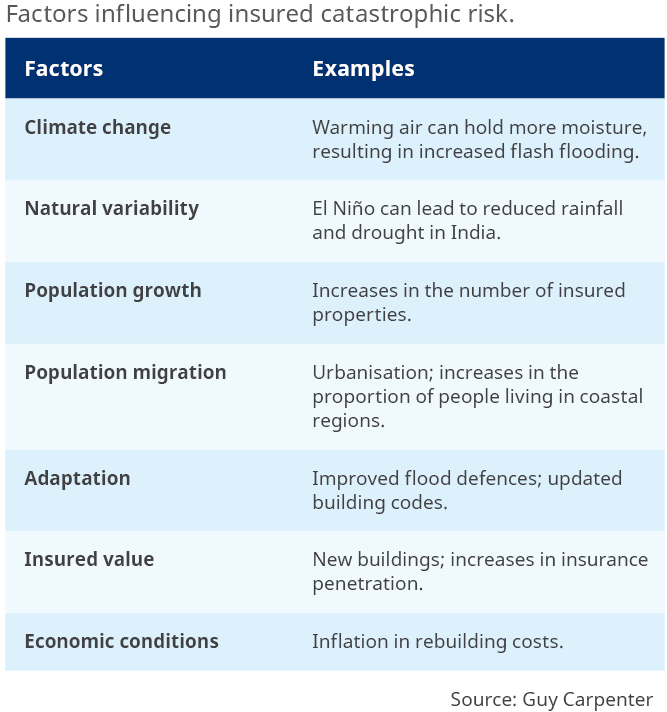

Climate change is not the only factor influencing how the financial catastrophic risk to re(insurers) changes from year to year. Climate change generally increases the risk gradually over time, although the financial impact may only be realised when a significant event occurs. In contrast, other factors can lead to more abrupt changes in risk, for example, inflation in rebuilding costs or the implementation of flood defences. These other factors will often have a larger impact than climate change, and we compare examples of them with climate change in the table below.

Managing Climate Change Physical Risk In India

Regulation

Climate change presents 2 key forms of financial risk: those associated with a transition to a lower-carbon economy, and those related to the physical impacts of climate change. The physical impacts can be assessed and reported as either chronic or acute. Chronic physical risks are gradual changes in weather patterns, such as rising sea levels, droughts and extreme temperatures. Acute physical risks are sudden and severe events that can cause significant damage to property and infrastructure, such as hurricanes, floods, wildfires and storms.

Mandatory reporting of these risks, often aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), has come into effect in several jurisdictions. Scenario analysis has also emerged as a key forward-looking tool to assess and disclose the potential impact of climate risks.

In India, there has been a push toward greater sustainability disclosures by financial institutions. The Reserve Bank of India (RBI) has acknowledged climate change risk as a systemic risk to the financial system, and in 2021 it joined a number of other central banks and financial supervisors as part of the Network for Greening the Financial System (NGFS). In addition, the Securities and Exchange Board of India (SEBI) has introduced mandatory ESG reporting requirements for the top 1,000 listed companies in India (by market capitalisation).

In July 2022, the RBI published a Discussion Paper on Climate Risk and Sustainable Finance, which provided a recommended disclosure framework for regulated entities in line with TCFD. Around the same time, the RBI also released a report detailing the results of their Survey on Climate Risk and Sustainable Finance. The survey aimed to evaluate the current state of climate risk and sustainable finance in leading commercial banks in India. The responses collected from the survey indicated that while the regulated entities acknowledge the importance of climate risk and consider it material, they have yet to align themselves with any international disclosure standards or implement scenario analysis or stress testing. The survey highlighted in particular the need for improved board-level engagement on climate risk.

Going forward, the RBI is expected to publish a number of guidelines on the topics of green finance, climate-related financial disclosures, and climate scenario analysis and stress testing. Although the regulation remains at a nascent stage, there is a growing interest from supervisors in India to bolster understanding and capabilities in climate change financial risk management.

Climate Change Impact by Peril

We evaluate the impact of climate change on a peril based on observations, climate models and our understanding of the physical drivers. In cases where we have a consistent view—a long observational record, high-resolution climate model output and a good understanding of the physical drivers—then we will have high confidence in our assessment. Conversely, there are many reasons why we would have lower confidence, for example, if an observational record is short or unreliable or there is disagreement between different climate models.

Here we summarise the climate change impact on floods, heat waves and drought, and tropical cyclones (TCs). Note that climate change does have a significant impact on a wide range of other perils, including wildfire and hail, but these typically have lower insured losses associated with them in India.

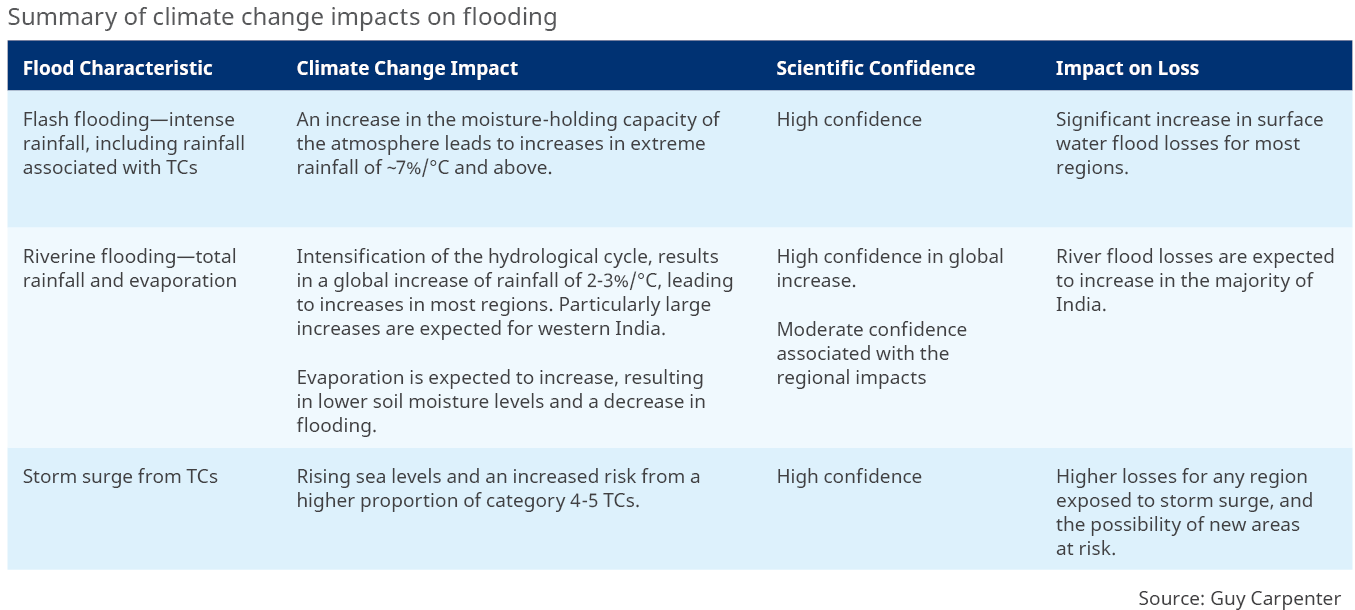

Climate Change Impacts on Flooding

The impact of climate change on flood is complex. Intense rainfall has a relatively direct link to surface water flooding—therefore, the climate change impact is generally well understood. In contrast, the response of river flooding to precipitation is dependent on a large number of factors, including soil moisture, temperature, snowmelt and catchment characteristics, and therefore changes are harder to predict and highly regional.

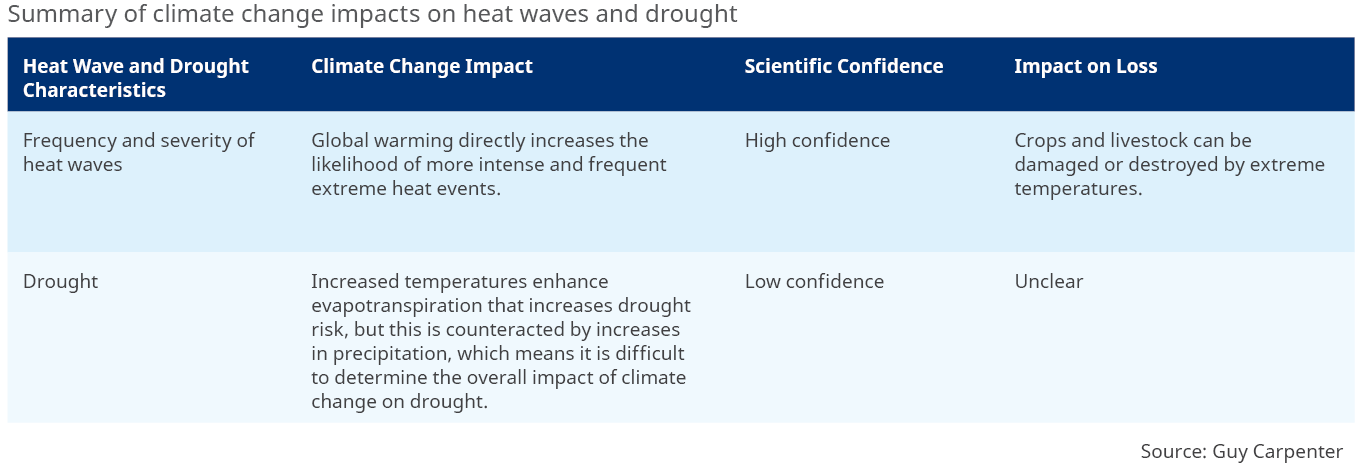

Climate Change Impacts on Heatwaves and Droughts

Climate change increases surface temperatures, generally increasing the risk of heat waves. The impact is amplified in hot regions, such as India, which are already close to critical temperature thresholds. In contrast, the impact of climate change on drought is more complex, as it is influenced by temperature, via evapotranspiration, and precipitation, in addition to human activities such as reservoir operation and water abstraction.

Climate Change Impacts on Tropical Cyclone

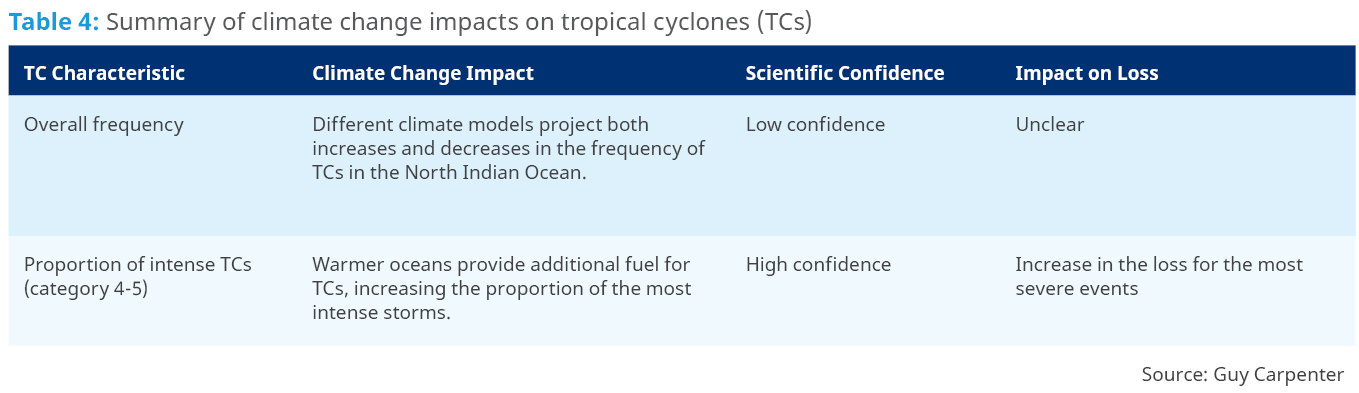

Climate change affects the frequency, severity and location of TCs in India, as outlined in the table below. The impacts are wide-ranging, as the energy source of TCs (the ocean), the winds that inhibit their growth (wind shear) and the large-scale circulation pattern that steers them are all affected. There are also implications for the precipitation and coastal flooding associated with TCs, included in the table Summary of climate change impact on flooding.

Quantifying your Climate Change Physical Risk

There are a growing number of reasons for quantifying your climate change risk:

- Responding to regulatory requests.

- Representation of risk to third parties, for example, credit rating agencies, investors or reinsurers.

- Making a TCFD-aligned climate disclosure.

- Incorporating climate change into risk management, pricing and capital decisions.

The type of risk assessment to carry out will be dependent on the use case. Important questions to consider before making any climate change assessment include the following:

- Is a qualitative or quantitative assessment required?

- What scenarios are of interest? This could be a specific emissions pathway and time horizon, for example RCP-8.5 in 2050, or instead a global warming level scenario, for example 1.5°C.

- Do you require an assessment of whether existing climate change is adequately represented in your current view of risk?

- What form of data is required to embed the climate change assessment in your existing decision-making processes?

Guy Carpenter is helping our clients address these questions and quantify their climate change physical risk through a variety of methods. For the quantification of the risk, Guy Carpenter has developed proprietary tools, ranging from underwriting and accumulation layers to adjustments to third-party catastrophe models and in-house probabilistic models developed for climate change. Furthermore, we have a broad overview of market practices that can help clients benchmark their own activities.

For India, we have an inland flood model adjustment that provides a fully probabilistic climate change assessment.

Conclusions

An improved scientific understanding of how perils are changing and the fact that an increasing number of regulators exploring climate-related disclosures means quantifying your climate change risk has never been more important. Doing so may also help avoid unexpected loss from evolving tropical cyclones and flood risk. It is also important to be aware that climate change may not be the most significant driver of changes in loss for your portfolio. Other factors, such as natural variability and inflation, should be properly considered to inform risk management, pricing and capital decisions.