Dr. Franziska Arnold-Dwyer and Julian Enoizi outline a sustainable climate-focused solution that combines financial resilience and loss-prevention measures that can reposition the role of insurance in tackling climate change. Failure to mitigate and adapt to the climate-change phenomenon as well as natural disasters and extreme weather events, are listed as the top 3 global risks over the next 10-year period as identified in The World Economic Forum’s 2023 Global Risks Report.1 Yet, although climate change is a common concern of humanity, climate action is held back by the “tragedy of the commons” whereby individual or isolated acts can neither reverse climate change nor increase resilience.

The Need For A Sea Change In Climate-Related Insurance

Dr. Franziska Arnold-Dwyer and Julian Enoizi outline a sustainable climate-focused solution that combines financial resilience and loss-prevention measures that can reposition the role of insurance in tackling climate change.

The 27th session of the Conference of the Parties of the United Nations Framework Convention on Climate Change (UNFCCC COP27) Sharm el-Sheikh Implementation Plan emphasizes that sustainable and just solutions to the climate crisis require “social dialogue and participation of all stakeholders.” In particular, capital from financial institutions and investors is needed to implement climate risk mitigation and adaptation measures and to enhance financial resilience to the adverse effects of climate change that are already being felt.

To create such a solution, we propose the development of a new (re)insurance structure that will facilitate financial resilience and loss prevention in relation to climate-related weather risks.

A paradigm shift in climate-related action

As insurers, risk managers and investors, the insurance industry is on the front line of the climate crisis. Insurance companies worldwide are already engaged in numerous climate initiatives at local levels, through public-private partnerships and via trans-national fora, such as the Net-Zero Insurance Alliance, the Global Shield against Climate Risk and the Insurance Development Forum. As risk advisors, Guy Carpenter believes a new operating model is required to address a crisis of this scale, one which promotes increased co-operation with governments, investors, and other stakeholders, as well as within the industry inter se, to build knowledge, capacity and impact.

That is why Guy Carpenter has collaborated with Dr. Franziska Arnold-Dwyer, a Senior Lecturer in Insurance Law and Sustainability at Queen Mary University of London.

Our contention is that the insurance industry needs a paradigm shift from the traditional post-disaster reaction approach towards an integrated climate risk approach that combines financial protection against the impact of climate-related losses and proactive support with loss-prevention measures.

The idea that risk prevention can be catalyzed with insurance is not so new. For example, health insurance providers have for many years incentivized healthy lifestyles through subsidizing gym memberships and motor insurance frequently rewards additional theft protection devices with a reduction in premium. Flattening the risk curve has been done in other areas of that at the time would have been deemed uninsurable risk. The invention of the safety belt allowed insurers to accept driving at increased speeds on motorways. The industry imperative is to develop the equivalent of the safety belt when insuring climate change.

We urge the insurance industry to go further by incentivizing action and rewarding climate risk adaptation and mitigation projects that reduce the climate-related risks they insure and ensure an ability to live with them.

An impactful solution of scale

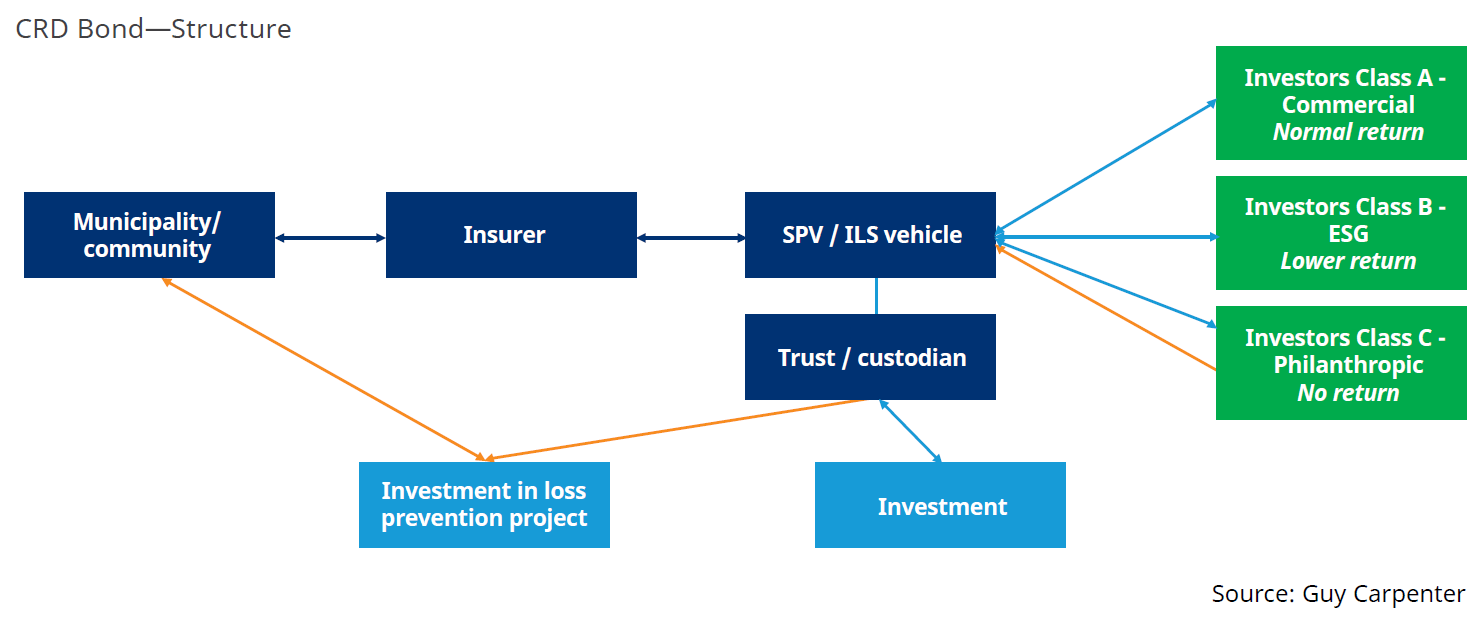

How can insurance companies—driven by creating shareholder value—facilitate the funds for loss-prevention projects, and how can they do so on a scale that has impact? We propose a solution that combines community-based insurance, stacked investment and advanced funding for loss-prevention measures in an enhanced insurance-linked security structure: the Climate Resilient Development Bond (CRD Bond).

Municipality M insures against a specified climate-related risk on behalf of a community with commercial insurer A on a multi-year basis. For example, a community-based catastrophe insurance flood protection pilot was recently launched in New York City to provide low-to-moderate-income households an assistance grant after a major flooding event.2

This insurance could operate on a parametric trigger basis. M pays premium to A. The premium becomes more affordable, and the insurance is more accessible, as the scheme is organized on a community-wide basis. In the CRD Bond structure, M has also identified, planned and approved a project that reduces or prevents losses from the insured climate-related risk. In this example, this would be a project focused on flood defenses, but for other climate-related risks the project could be an irrigation or water recycling facility, or a housing refurbishment project that boosts windstorm resistance, or other measure.

Insurer A reinsures the risk with an insurance special purpose vehicle (ISPV) that acts as a risk transformer. The ISPV passes the risk into the capital markets by issuing bonds or notes to capital market investors. All investors will pay the principal (the purchase price for a note). We envisage that there will be different classes of investors differentiated by their philanthropic and risk appetite—this is the capital stack. Thus, commercial investors (C) and ESG investors (E) will pay principal that is purely risk-based, while philanthropic investors (P) will pay a principal that has a risk-based element but is predominantly project-funding oriented.

In a traditional catastrophe bond structure, both the aggregate principal amount received from the investors and the premium received by the ISPV—and equivalent to or exceeding in amount the anticipated exposure to claims–would be deposited into a collateral account administered by a trustee who would arrange for those funds to be invested. In the CRD Bond structure, the aggregate principal amount received from the investors and the premium received by the ISPV are deposited into 2 separate accounts administered by a trustee:

- The risk-based principal amount and the premium are deposited into a collateral account administered by a trustee who would arrange for those funds to be invested; and

- the project-funding elements are allocated to the project fund account for immediate and ongoing funding for the loss-prevention project.

The E and P investors will receive a lower coupon as a lesser amount of their principal/collateral is invested in return-generating assets. The P investor coupon is fully donated, and the E investors’ coupon is partially donated to the project fund account. If a qualifying event occurs (in this example, flooding meeting the trigger criteria), insurer A pays a claim to M for distribution to the affected households, and the ISPV will draw on the collateral to make a payment reimbursing insurer A.

As the collateral reduces, coupon payments will reduce too. Upon the implementation of the loss-prevention project, the risk profile of the structure should improve, and the risk of a triggering event and subsequent payment should diminish. The risk reduction could be monetized by offering premium rebates and/or reducing coupon payments to C, E and P, and such savings would be used as further funding for the project.

At the end of the term of the CRD Bond, the remaining collateral is returned to the investors. The order of priority in repayment should be P investors, then E investors and last, C investors, reflecting the fact that the C investors should bear the greatest risk of loss having had the greatest return.

Challenges we must rise to

We recognize that the CRD Bond comes with underwriting, modeling, legal and logistical challenges. In fact, we are aware of earlier attempts to launch so-called resilience bonds3 that could not be modeled to scale the savings associated with the risk reduction to the project costs and the time lag associated with the implementation of an infrastructure project. We think that the scale can be improved by community-based insurance.

As research into climate-change mitigation and adaptation measures advances,4 we must also consider local projects that can be identified on science-based evidence and implemented within the terms of the CRD Bond. We also acknowledge that the funding derived from monetizing the risk reduction may not match the full costs of the project.

However, it will be a contribution that could make the difference between the project being financially feasible or unaffordable for the relevant community. In addition, we would hope that there is P and E investor appetite for the CRD Bond as an investment opportunity with clear social and environmental objectives, as well as support from public-private partnerships. As noted above, solutions to the climate crisis and its effects require collaboration at all levels, including from the insurance industry and the financial markets.

We remain convinced that the insurance industry can rise to the challenge and create a sea change in how its role in addressing the climate crisis is perceived. We consider that the CRD Bond is a sustainable solution to combining financial resilience and loss-prevention measures consistent with the principles of equity, sustainable development, co-operation, and the precautionary principle5 that underpins the Paris Agreement.

The CRD Bond has the potential to make an impactful contribution from the insurance industry to the implementation of sustainable and just solutions to the climate crisis, as well as heralding a paradigm shift for climate change insurance and beyond by bringing ”loss prevention” into focus. It is imperative that insurers, governments, investors, philanthropists, and other stakeholders work with the authors to turn that potential into a market reality.

Biographies

Dr. Franziska Arnold-Dwyer, Director of the Insurance, Shipping & Aviation Law Institute at the Centre for Commercial Law Studies, Queen Mary University of London and Julian Enoizi, Global Head of the Public Sector Practice, Guy Carpenter.

1. https://www.weforum.org/reports/global-risks-report-2023

2. This base scenario is based on a recently launched Parametric Flood Program for New York City where reinsurer Swiss Re Corporate Solutions, reinsurance broker Guy Carpenter, registered broker/dealer MMC Securities LLC, and data technology firm ICEYE teamed up with a non-profit organization in New York City to develop a pilot parametric flood recovery assistance program for low- and-moderate-income households in the city. This program was funded by the National Science Foundation (NSF) and spearheaded by the Environmental Defense Fund (EDF).

3. https://www.trading-risk.com/article/29o65vrdorizfddm9bhts/resilience-bonds-a-concept-too-ambitious-or-ahead-or-its-time

4. See e.g. Intergovernmental Panel on Climate Change, AR6 Climate Change 2022: Impacts, Adaptation and Vulnerability and AR6 Climate Change 2022: Mitigation of Climate Change

5. The precautionary principle holds that where there is a threat of serious or irreversible damage, lack of full scientific certainty should not be used as a reason for postponing appropriate measure to prevent environmental harm or damage.

The Need For A Sea Change In Climate-Related Insurance

Dr. Franziska Arnold-Dwyer and Julian Enoizi outline a sustainable, climate-focused solution that combines financial resilience and loss-prevention measures that can reposition the role of insurance in tackling climate change.