GC Cat Studio

GC Cat Studio has been designed to help you make better risk-informed decisions with a suite of easily accessible catastrophe resources for everything from modeling to model intelligence to impact scores.

Pricing and Risk Selection

Pricing and Risk Selection enables clients to price and underwrite catastrophe-exposed business in real time. It provides hazard insights, local accumulation details, catastrophe-modeled loss metrics, and the expert advice to implement an effective pricing strategy

Catastrophe Risk Assessment

Catastrophe Risk Assessment capabilities help companies make better risk-informed decisions through model analysis and expert advice on using catastrophe models effectively

Portfolio Management and Optimization

Portfolio Management and Optimization capabilities have been designed to help companies plan, view, calibrate, and set strategy.

Risk Transfer Solutions

Risk Transfer Solutions provide proprietary structuring and placement services, and customized coverage solutions based on GC proprietary methodology and internal expertise.

Enterprise Advisory

Enterprise Advisory provides expertise and solutions to advise clients on catastrophe impact to capital, ratings, risk tolerance, and benchmarking.

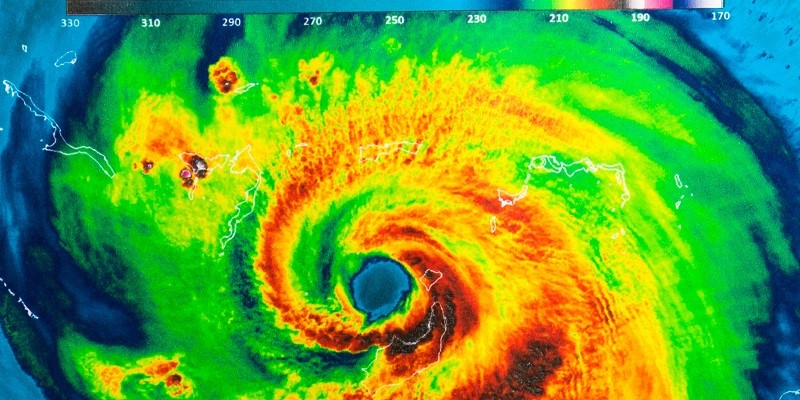

Event Response

Event Response capabilities couple real-time events with in-force policy data to quickly identify and manage at-risk exposures globally.