Risk Types

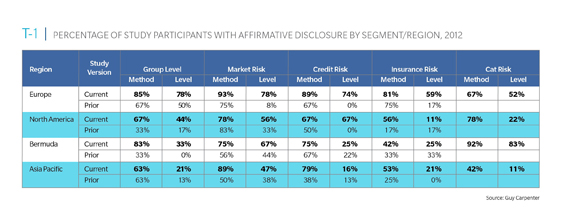

Table 1 (below) quantifies the proportion of companies in the sample that disclose the method as well as the specific level of various risk quantifications. Compared to our previous ERM benchmark study, a new metric referring to catastrophe risk has been added. Taking advantage of the increased level of disclosure and transparency on catastrophe risk exposure, we have extended our reports to include this in view of its importance in the economic capital approach of (re)insurers.

For the different risk types, the general level of disclosure has increased, indicating growing attention together with improved measurement capabilities. Moreover, the quality of the disclosure shows a real break with the past as companies now disclose detailed quantitative data about the different risk categories.

Looking in detail at the information published by our sample companies, we can observe that:

- Multinational companies tend to align to global regulation developments (like Solvency II) independent of their headquarters location. This may be seen as a sign of a greater integration of the different markets.

- Europe remains the continent where insurers disclose the most information. European insurance companies generally disclose more details about their existing risk management processes and the quantitative levels for the different individual risk types. The higher level of disclosure is mainly driven by regulatory requirements and the preparation for the Solvency II regime.

- Some companies were well advanced in publishing their ERM processes in the past, for example they presented detailed descriptions of the integration of risk results in their value-based management systems. However, this has been reduced to a certain lower standard all over Europe.

- For Asia Pacific, Bermuda and North America we can see a big step forward in ERM process publication compared to our previous studies. The disclosure quality in these regions has become more homogeneous. While the method used to calculate different risk types is often described, the companies are still more reluctant to publish detailed results.

- The path to better and more detailed disclosures is probably driven by two factors. First, the disclosure improvement is driven by international competition, rating agencies and financial analysts. Second, the Solvency II discussion around third-country equivalence has forced companies outside of Europe to have a closer look into the risk management procedures and publication standards used in Europe.

- For the catastrophe risk metric, the level and quality of disclosure are generally sound for illustrating the critical importance of this risk in the ERM process. This level of disclosure is also supported by the importance of analytical tools in place in this area.

Risk Governance

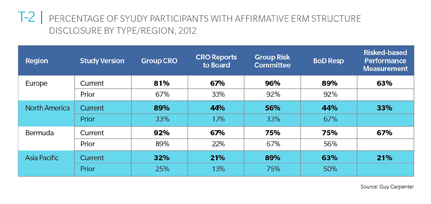

Table 2 shows disclosure percentages on the risk-based governance practices of the sample selected companies. Compared to the previous results, a new indicator for the number of companies linking performance measurements and incentive plans to risk-based proxies has been studied. This survey is helpful for looking at the integration process of a risk-based culture inside organizations.

Observations

- The general disclosure level on risk-based governance practices has increased in all territories.

- In our previous survey, Bermudian and European companies tended to disclose more structural ERM information than companies in United States. This new survey confirms this. Bermuda companies are now relatively close to European (re)insurers in their level of structural disclosure. Asia Pacific and U.S. (re)insurers continue to lag behind their European and Bermudian peers.

- Not all companies are disclosing the presence of their own chief risk officer (CRO), especially in Asia Pacific. But almost all companies disclose that they are supporting this role, sometimes by delegating it to the chief financial officer or to the chief actuary. The board of directors is usually held responsible for the overall corporate strategy. In Europe and Asia Pacific the disclosure suggests that governance is characterized by a more centralized approach with higher levels of accountability.

- Disclosure indicating better integration of risk management into the performance and incentives policy appears to be consistent with the increased requirements imposed by new regulation, such as Solvency II and the NAIC's regulators seek third-country equivalence to Solvency II requirements, this integration seems to be more important and also more consistent.