Jonathan Clark, Managing Director and Cheryl Lorenz, Vice President

In September 2016, the Federal Emergency Management Agency (FEMA) took the historic step of purchasing reinsurance for the National Flood Insurance Program (NFIP).

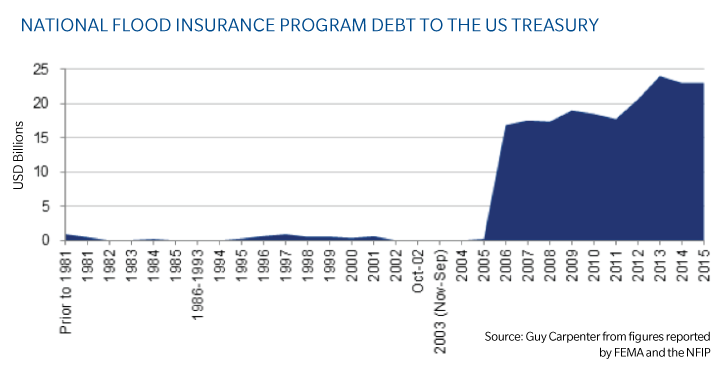

The NFIP is the primary underwriter of flood insurance policies in the United States. The program was established in 1968, and since its formation, has never utilized any financial risk transfer mechanisms. Instead, it has relied on the US Treasury to fund deficits when losses have exceeded the Program's claims paying capacity. Annual financial outlays resulting from flood are the most routine and expensive of all US natural catastrophe perils.

In the years since Hurricane Katrina, two significant pieces of legislation have been passed by US lawmakers that focus on the structural challenges surrounding the flood program - the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12) and the Homeowner Flood Insurance Affordability Act of 2014 (HFIAA 2014). Through BW-12 and HFIAA 2014, FEMA was given authority to secure reinsurance from the private sector, thereby providing the Federal Insurance and Mitigation Administration (FIMA), the entity within FEMA that manages the NFIP, an additional means to manage the financial consequences of catastrophic flood risk.

The launch of the FEMA 2016 Reinsurance Initiative, (1) while ground-breaking, is actually the logical next step in a series of actions initiated by Congress when the NFIP was last reauthorized in September 2012, through BW-12. These actions were prompted in part by Hurricane Katrina, which resulted in USD 16.3 billion of losses to the NFIP in 2005. Subsequently, losses from Hurricane Sandy in October 2012 added to the NFIP deficit, which now stands at USD 23 billion to the US Treasury.

The structure of FEMA's inaugural 2016 placement is designed to support the NFIP reinsurance initiative and a larger-scale program expansion in early January 2017. The reinsurance treaty is designed to transfer risk while simultaneously providing FIMA with a vehicle to live-test the systems, protocol and processes required to execute a broader scale program across the global reinsurance market.

FEMA describes their criteria for successful implementation of this 2016 placement: (2)

- determine and enhance market outreach and placement processes and procedures in advance of early January 2017;

- enhance reinsurance claims payments processes and procedures in advance of January 2017 to ensure reinsurance recoveries are readily available to pay policyholder claims quickly and effectively; and

- establish and upgrade a full reinsurance program strategy, design and overall operation based on lessons learned.

Notes:

1. http://fema.gov/blog/2016-09-21/testing-new-tool-strengthen-flood-insurance

2. FEMA.gov