Jonathan Clark, Managing Director and Cheryl Lorenz, Vice President

The new reinsurance program consists of a USD 1 million limit to protect against flood claim losses to the National Flood Insurance Program (NFIP) that exceed USD 5 million in order to test the Federal Emergency Management Agency's (FEMA) ability to receive reinsurance claim payments and process reinstatement premium. Once that USD 1 million limit is exhausted, the reinsurance will be reinstated for an additional USD 1 million limit to protect against large flooding events that generate losses to the NFIP in excess of USD 5.5 billion. Given the geographic spread of NFIP policyholders, such events would most likely result from flood losses that were related to a large tropical storm or hurricane.

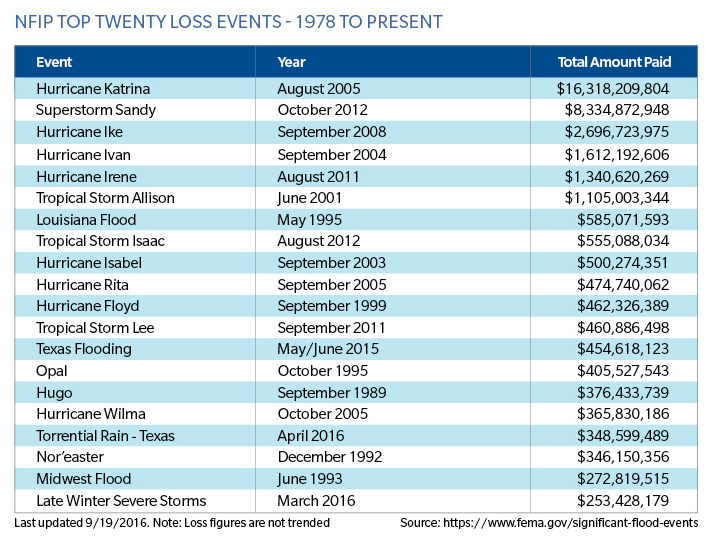

This is supported by a review of historical NFIP losses:

FEMA indicated that they intend to follow a path toward implementation of a larger-scale reinsurance program over the next several years. The level of risk that will be transferred to reinsurers in January 2017 is unknown at this time but FEMA has acknowledged that ultimately their goal is to broaden the NFIP's claims-paying ability and mitigate the accumulation of future debt.

The NFIP Reinsurance Initiative follows the work FEMA conducted through the Flood Insurance Risk Study (FIRS), which was required by Congress under the Biggert-Waters Flood Insurance Reform Act of 2012. FIRS focused on two topics: 1) reinsurance and how that might support the NFIP; and 2) options that FEMA could consider for expanding private sector involvement and support around the NFIP. This work provided FEMA with more exposure to the reinsurance industry's analytics surrounding storm surge and inland flood modeling, which over time will benefit and support a more robust risk management effort for the NFIP. (1)

Looking to the Future

Guy Carpenter believes a fully functional private-public partnership between FEMA, private sector flood insurers and reinsurers will benefit original policyholders and communities grappling with the challenges of flood risk. The FEMA 2016 reinsurance initiative is a positive step in this regard that aligns closely with FEMA's advised long-term vision of increasing the number of flood policies in the United States:

- Reinsurers' interactions with FEMA and their work with NFIP data will produce greater familiarity with the nature of flood losses and exposures and expand availability of US reinsurance flood capacity over time. An expanded flood reinsurance market will also benefit primary insurers' ability to assume risk and improve flood insurance availability, signaling easier access to flood coverage and potentially lower costs for policyholders.

- Greater access to flood data, loss results and more reliable exposure modeling may bring change to the flood insurance/reinsurance marketplace as new capital sources and alternative risk transfer markets can be engaged - collateralized reinsurance, catastrophe bonds, sidecars, derivatives and other vehicles may be options. In addition to bringing capacity to the table, they will spur innovation and promote more efficient pricing through increased competition.

Note:

1. https://www.floods.org/ace-files/documentlibrary/2012_NFIP_Reform/ Reinsuring_NFIP_Insurance_Risk_and_Options_for_Privatizing_the_NFIP_Report.pdf